🏢 Veedol Corporation Ltd

Veedol Corporation Limited, which recently rebranded from Tide Water Oil Co. (India) Ltd., stands as a major international force in lubricant manufacturing.

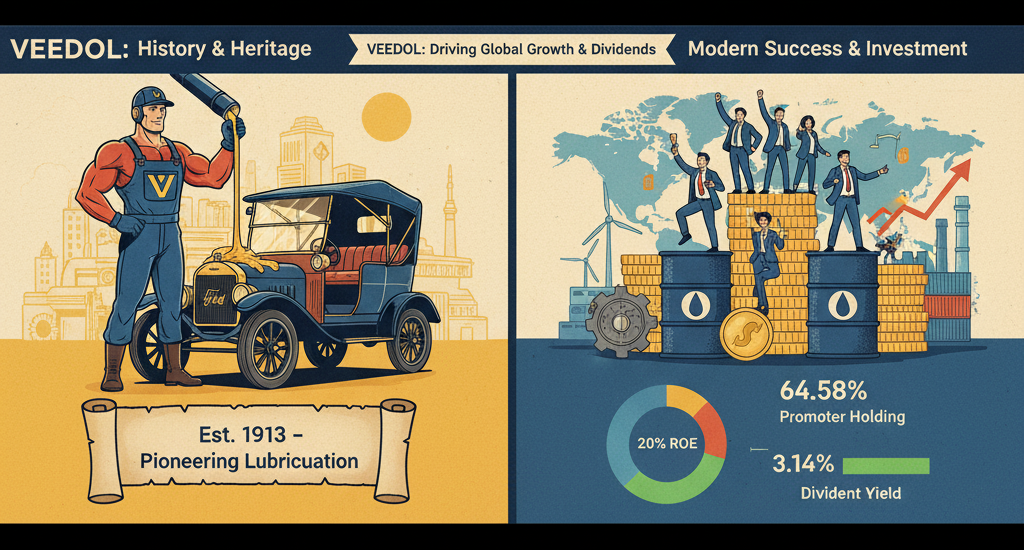

The company is the proud owner of the historic Veedol brand, which traces its origins back to 1913. Leveraging this strong heritage, Veedol Corporation now manufactures a comprehensive range of automotive and industrial oils.

Globally headquartered in Kolkata, India, the company maintains worldwide operations. Its strategic activities include a significant joint venture with Japan’s Eneos and key acquisitions, such as that of a firm in the United Kingdom, strengthening its international presence and product portfolio. Veedol Corporation is a recognized publicly listed company on the Indian stock exchanges.Veedol Corporation Limited, which recently rebranded from Tide Water Oil Co. (India) Ltd., stands as a major international force in lubricant manufacturing.

The company is the proud owner of the historic Veedol brand, which traces its origins back to 1913. Leveraging this strong heritage, Veedol Corporation now manufactures a comprehensive range of automotive and industrial oils.

Globally headquartered in Kolkata, India, the company maintains worldwide operations. Its strategic activities include a significant joint venture with Japan’s Eneos and key acquisitions, such as that of a firm in the United Kingdom, strengthening its international presence and product portfolio. Veedol Corporation is a recognized publicly listed company on the Indian stock exchanges.

Financial Highlights for a Dividend Investor

For investors prioritizing a dividend-focused portfolio, Veedol Corporation Ltd. presents compelling financial characteristics centered on safety, yield, and profitability. Below are five key data points supporting its appeal as a dividend stock:

1. Superior Dividend Yield and Payout Commitment

Veedol’s Dividend Yield of 3.14% is significantly higher than the median yield of its industry peers (1.45%), making it an attractive source of passive income. This is reinforced by a healthy Dividend Payout Ratio of approximately 59.5%, which confirms management’s sustained commitment to distributing a large portion of earnings directly to shareholders.

2. High and Consistent Profitability

The company demonstrates excellent operational efficiency, crucial for sustaining dividends. Its Return on Equity (ROE) has consistently been high, averaging 18% over 10 years and recently hitting 20%. Similarly, the Return on Capital Employed (ROCE) stands at 23.7%, indicating the business is highly effective at generating profits from its capital base.

3. Financial Stability and Minimal Debt Risk

A cornerstone of dividend safety is a low debt profile. Veedol is noted as being “almost debt-free.” This minimizes financial risk, ensuring that corporate profits and cash flows are dedicated to growth and dividends, rather than servicing external debt obligations.

4. Robust Profit Growth Trajectory

The ability to increase future dividends relies on growing profits. Veedol has delivered a solid 3-year Compounded Profit Growth of 12% (with Trailing Twelve Months (TTM) profit growth at an even higher 31%). This growth trajectory is the fundamental driver that enables the company to consistently announce higher dividends over time.

5. Increasing Management Confidence

Promoter holding—the stake held by the company’s founders and core management—has steadily increased, reaching 64.58% as of September 2025. This rising stake is a strong vote of confidence from the individuals with the most intimate knowledge of Veedol’s long-term value and stability.

Summary of Key Metrics for Dividend Investment

| Metric | Value | Investment Implication |

| Dividend Yield | 3.14% | Above industry median, providing attractive income. |

| Dividend Payout Ratio | 59.5% | Commitment to distributing earnings. |

| Return on Equity (ROE) | 20% (Latest Year) | High efficiency in generating profit from shareholder capital. |

| Debt to Equity Ratio | Near Zero | Minimal financial risk; “almost debt-free.” |

| 3-Year Profit CAGR | 12% | Sustained profit growth to fuel future dividend increases. |