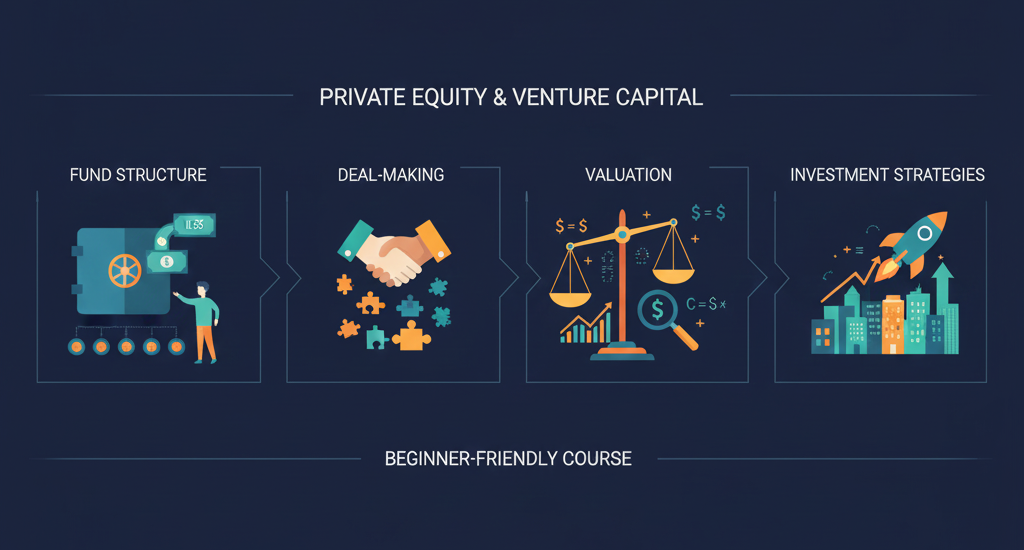

Private equity and venture capital have become two of the most powerful engines behind business growth, innovation, and global entrepreneurship. While public markets such as stock exchanges are widely known and discussed, the world of private markets—where private equity (PE) and venture capital (VC) operate—remains more exclusive and less understood. Coursera’s course on Private Equity and Venture Capital aims to bridge this knowledge gap by offering learners a solid foundation in how private markets function, how investments are made, and how value is created through strategic funding.

This course serves as an accessible entry point for finance students, professionals, entrepreneurs, and anyone curious about how companies are funded before they reach the public market or grow into industry leaders. It breaks down the complex workings of PE and VC into understandable concepts and practical frameworks. What makes it valuable is not just the theory but the real-world understanding it brings to how investors and entrepreneurs collaborate across a company’s lifecycle.

The course starts by explaining what private equity and venture capital actually are. Though people often use these terms interchangeably, the course clarifies the distinction. Venture capital typically focuses on early-stage companies—startups that have big ideas but limited resources. These companies often need funding to build prototypes, hire teams, test the market, and scale operations. Private equity, on the other hand, deals with more mature companies. PE investors often step in when a business is seeking expansion, restructuring, or strategic improvements. Understanding these differences is essential because the way money is invested, the level of risk involved, and the expectations of return vary significantly between the two.

One of the strengths of the course is how it dives into the legal, taxation, and structural foundations of private market investments. In public markets, buying and selling shares is straightforward. In private markets, however, deals are much more complex. Investors must consider legal structures for funds, limited partnership agreements, capital commitments, and regulatory frameworks. Taxation also plays a critical role in determining how fund managers structure investments and how returns are distributed. Without understanding these underlying elements, it becomes difficult to grasp why private equity investments work the way they do, or why they are structured differently from traditional stock market investments.

Another key area covered in the course is the inner workings of private equity and venture capital funds. Many people know that investors contribute money to these funds, but few understand the detailed mechanics behind fundraising, capital deployment, and fund governance. The course demystifies this by explaining who the main players are—limited partners (LPs), general partners (GPs), and portfolio managers. LPs typically include pension funds, insurance companies, wealthy individuals, and institutions looking for long-term returns. GPs are the professionals who manage the fund, scout investment opportunities, evaluate deals, and decide where to allocate capital.

The course also explains how funds raise money, how they commit that money into promising ventures, and how they manage the investment cycle. Students learn how funds aim to balance risk and reward, how they diversify portfolios, and how fund managers make decisions that could impact companies and investors for years to come.

A major focus of the course is valuation and deal-making, which are crucial in both private equity and venture capital. Unlike public companies whose stock prices are visible on exchanges, private companies don’t have a market-assigned value. That means investors need special techniques to estimate worth. The course teaches various valuation methods—such as discounted cash flow (DCF), multiples, and comparable transactions—while explaining how these methods must be adapted to private markets. Students also learn how investors assess a company’s potential for growth, manage due diligence, and negotiate deal terms such as equity stakes, convertible notes, and liquidation preferences.

These insights help learners understand not just how investments are made, but why certain businesses become attractive opportunities while others don’t. Due diligence, for instance, is a critical step where investors analyze financial statements, business models, management capabilities, market conditions, and competition. A poor due diligence process can lead to major losses; a strong one can lead to impressive returns.

Throughout the course, learners also gain valuable practical skills that are directly applicable to careers in finance, entrepreneurship, and investment analysis. These skills include financial modeling, evaluating business growth prospects, understanding investment structures, and analyzing exit strategies such as acquisitions, buyouts, and IPOs. These competencies are especially helpful for individuals aspiring to work in investment banking, consulting, private equity firms, or startup ecosystems. Even entrepreneurs benefit from understanding how investors think, because it helps them prepare better pitches, negotiate term sheets, and structure deals that benefit both founders and investors.

One of the best aspects of the course is its flexibility. Designed to be completed at your own pace, it fits well into the schedule of working professionals or students with busy routines. With around eight hours of total content, it’s concise but informative, giving learners enough depth to build confidence in the subject without being overwhelming. The option to earn a shareable certificate also adds value, as it can be included on résumés, LinkedIn profiles, and professional portfolios.

The course stands out because it translates complex financial concepts into clear, digestible lessons. Whether someone has prior finance knowledge or is encountering these topics for the first time, the explanations remain accessible. By the end, learners not only understand private equity and venture capital in theory, but also see how these investment vehicles affect real companies in the real world.

Private equity and venture capital shape some of the most important economic developments today—from startup innovations that disrupt industries to major buyouts that redefine corporate giants. Understanding how these systems work provides insight into how businesses grow, how investors evaluate opportunities, and how financial strategies influence long-term success. Coursera’s course offers a strong foundation in this powerful area of finance, making it a valuable stepping stone for anyone looking to deepen their knowledge or pursue a career in the investment world.