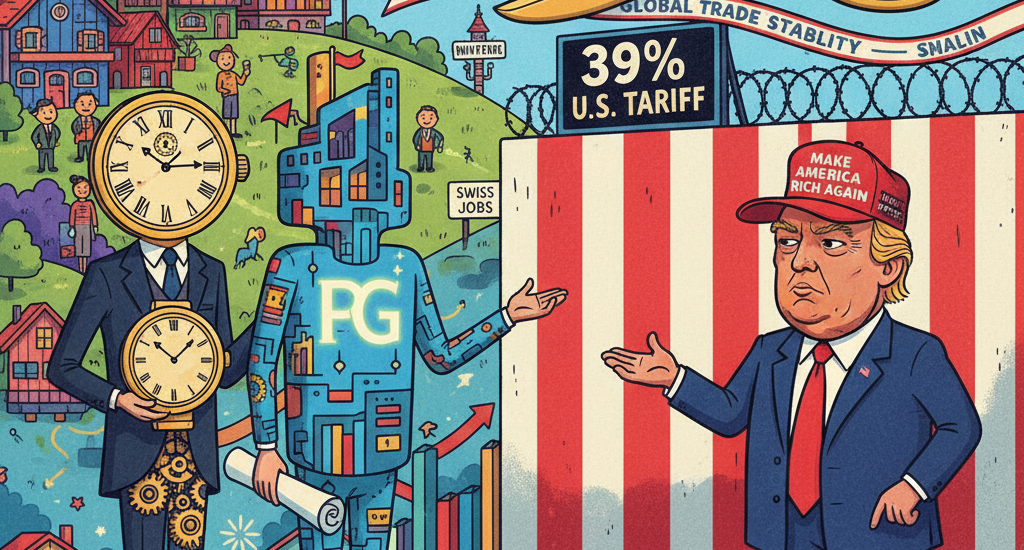

In a bold and rare move, top executives from Switzerland’s most prominent companies, including Rolex and Partners Group, have gone straight to the heart of power — Washington D.C. — to appeal directly to former U.S. President Donald Trump over the 39% tariff imposed on Swiss imports. This unprecedented tariff hike has sent ripples across global trade corridors and rattled the Swiss export sector, long celebrated for its precision, quality, and reliability.

As a market analyst observing the pulse of global trade, this development is more than just another trade headline. It’s a wake-up call — not only for Swiss exporters but also for investors and policymakers worldwide — about the fragility of global supply chains in the face of shifting political and economic tides.

The Unlikely Lobby: Rolex, Partners Group, and Swiss Industry Titans Unite

For decades, Switzerland has enjoyed a reputation for quiet diplomacy, political neutrality, and stability — qualities that have allowed its corporations to thrive globally without overt political interference. So, when the CEOs of Rolex, Partners Group, and several other Swiss giants decided to take their plea directly to the U.S., it signaled the seriousness of the situation.

The 39% tariff slapped on Swiss goods by the U.S. government marks one of the steepest duties levied on a developed economy. For an export-driven country like Switzerland, where watchmaking, precision instruments, and financial services form the backbone of national revenue, this tariff isn’t just a bureaucratic issue — it’s a potential blow to profitability, competitiveness, and long-term trade relations.

The delegation included representatives from sectors beyond watches — including gold refining, commodity trading, and shipping — reflecting how widespread the tariff’s impact truly is. These industries together contribute billions to the Swiss GDP and employ thousands globally.

The Tariff Shock and Its Economic Ripple Effect

The Swiss economy thrives on exports. Roughly 70% of Swiss GDP is tied to international trade, with the United States being one of its top export destinations. Products like luxury watches, pharmaceuticals, and machinery dominate the export list.

With a 39% tariff, the price competitiveness of Swiss goods in the U.S. market takes a heavy hit. For companies like Rolex, which already operate at premium pricing levels, passing on the full cost to consumers risks alienating buyers, especially when competing with brands from nations not subject to such steep duties.

For mid-tier exporters and industrial suppliers, the challenge is even greater. Margins in manufacturing and precision equipment are already tight. Absorbing additional costs could erode profits and, in the worst case, lead to layoffs or reduced production.

Investors, too, are watching closely. The Swiss Market Index (SMI) has shown signs of pressure, particularly in export-heavy stocks. Meanwhile, U.S.-listed retailers that depend on Swiss imports — from high-end watch boutiques to pharmaceutical distributors — are bracing for potential supply disruptions or higher inventory costs.

Behind the Move: Trump’s Trade Strategy and Its Global Impact

The Trump administration’s decision to impose tariffs on Swiss goods is part of a broader push to rebalance trade relationships that it deems unfair. The U.S. trade deficit and the dominance of foreign manufacturing have been recurring themes in Trump’s economic playbook, and Switzerland — despite its small size — has not escaped scrutiny.

From Washington’s perspective, the tariffs are a tool to encourage domestic production and renegotiate trade terms. From Switzerland’s standpoint, however, it feels like a diplomatic snub to one of the world’s most reliable trade partners.

The direct appeal by business leaders is both strategic and symbolic. It bypasses slow-moving government diplomacy and instead leverages personal engagement with the political figure who still wields significant influence in U.S. trade policy discussions.

Corporate Diplomacy in Action

The fact that Rolex and Partners Group led this delegation underscores how even traditional, discreet Swiss companies are evolving in their global engagement. These firms recognize that in a world where politics increasingly shapes economics, corporate diplomacy can be as crucial as financial strategy.

Rolex, beyond being a luxury watchmaker, represents Switzerland’s craftsmanship and precision — traits synonymous with the Swiss brand itself. Partners Group, a major investment firm managing over $150 billion globally, stands for Swiss financial strength and credibility. Together, they represent both the heart and the wallet of the Swiss economy.

By taking their concerns directly to Trump, these executives sent a clear message: the tariff is not just hurting corporate profits — it’s damaging bilateral trade relations and potentially consumer choice in the luxury and manufacturing markets.

Market Implications: What Investors Should Watch

For investors, this development raises several important considerations:

- Swiss Exporters Face Margin Pressure:

Companies like Swatch Group, Richemont, and even niche watchmakers may see profit margins tighten as they grapple with higher tariffs and possible supply chain disruptions. Investors holding shares in these firms should monitor quarterly earnings and forward guidance closely. - U.S. Retailers Could Face Price Hikes:

U.S.-based luxury retailers that rely heavily on Swiss imports — such as high-end watch stores or authorized distributors — may have to raise prices, risking a slowdown in sales volumes. - Currency Movements:

The Swiss franc, traditionally a safe-haven currency, could experience volatility as markets react to changing trade expectations. A prolonged tariff regime might weaken the franc slightly to maintain export competitiveness. - Policy Shifts and Negotiation Outcomes:

The White House’s openness to further discussions suggests the potential for eventual tariff adjustments. Investors should stay alert for news of upcoming negotiations or trade concessions, which could provide relief rallies for affected stocks.

Beyond the Numbers: The Human Side of Trade

While the global focus remains on trade balances and corporate profits, it’s important to remember the human side of this story. Tariffs don’t just affect boardrooms — they impact thousands of skilled workers, artisans, and supply chain partners who depend on exports for their livelihoods.

In the Swiss watch industry, for instance, generations of craftsmen rely on steady global demand. A sudden tariff spike could mean fewer exports, trimmed production lines, and job insecurity in communities that have built their identity around precision watchmaking.

Moreover, consumers in the U.S. could also feel the impact. Higher tariffs on Swiss goods may translate to steeper prices for luxury watches, machinery, and specialized medical instruments — effectively making premium Swiss quality harder to afford.

The Road Ahead: Diplomacy or Division?

After the meeting, reports indicated that the White House was open to “further trade negotiations.” While no immediate deal was struck, this gesture provides a glimmer of hope. The U.S. and Switzerland share long-standing financial, technological, and cultural ties that neither side can afford to jeopardize.

For investors and businesses, this is a crucial period of observation. Whether the situation leads to tariff relief or escalates into a prolonged trade standoff will determine not just short-term market moves, but the future trajectory of U.S.-Swiss economic relations.

Conclusion: A Lesson in Global Interdependence

The Rolex and Partners Group initiative highlights a fundamental truth of modern economics — that markets are as much about relationships as they are about numbers. In a world increasingly shaped by political decisions, corporate leaders can no longer remain silent observers.

For investors, the message is clear: monitor not just earnings, but also diplomacy. Because in times like these, trade talks in Washington can move markets in Zurich.

As Switzerland’s top executives step into the political arena, they remind us that global trade is a two-way street — one that thrives not on tariffs, but on trust, cooperation, and mutual respect.

In short: the Swiss tariff standoff isn’t just a story about taxes and trade — it’s a reflection of how even the most stable economies must now navigate the unpredictable currents of geopolitics to protect their future.

One thought on “Rolex and Partners Group Take Swiss Tariff Plea Direct to Washington — What It Means for Markets”

Comments are closed.