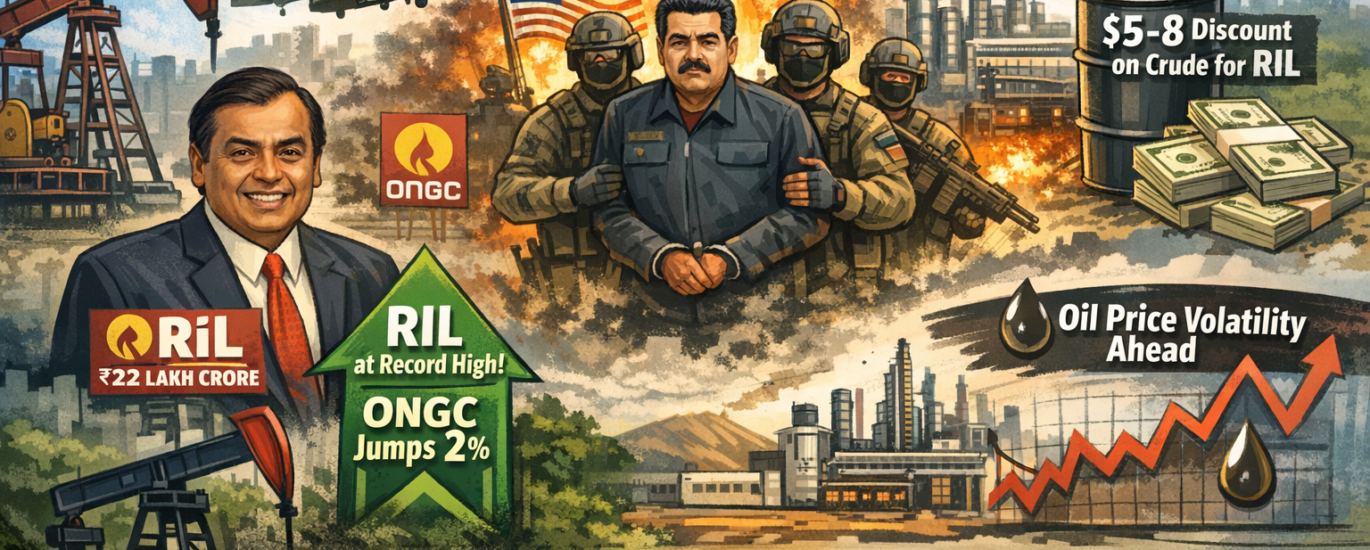

Indian stock markets witnessed strong action in oil and energy stocks as Reliance Industries (RIL) touched a record high, while ONGC surged nearly 2%, following dramatic geopolitical developments involving the United States and Venezuela. The rally was driven by expectations of changes in global crude supply dynamics and potential benefits for Indian oil companies.

Market experts believe that the developments could have short-term positive implications for select Indian energy stocks, though risks remain in the medium to long term.

Market Reaction: RIL and ONGC Lead the Gains

On the back of global cues, ONGC emerged as one of the top gainers on the Nifty 50, rising around 2% in early trade. Meanwhile, Reliance Industries shares climbed over 1% to hit a fresh lifetime high, strengthening its position as India’s most valuable company.

RIL’s rally pushed its market capitalisation close to ₹22 lakh crore, reflecting strong investor confidence in its diversified business model spanning energy, retail, and digital services.

The broader oil and gas sector also remained firm as investors reacted to the sudden escalation in geopolitical tensions linked to Venezuela — a key oil-producing nation.

What Triggered the Rally? US Action in Venezuela

The stock movement followed reports of a major US military operation in Venezuela, reportedly aimed at targeting the country’s leadership. The operation, referred to as “Operation Absolute Resolve”, has raised speculation about a possible regime change or restructuring of Venezuela’s oil sector.

Venezuela holds one of the largest proven crude oil reserves in the world, but years of sanctions, political instability, and underinvestment have severely restricted its production and exports.

Any significant change in US-Venezuela relations is likely to impact global crude oil supply, making energy markets highly sensitive to the news.

Why This Matters for Indian Oil Companies

According to analysts, especially global brokerage Jefferies, the developments could have mixed but potentially favourable implications for Indian oil majors like RIL and ONGC.

Benefits for Reliance Industries (RIL)

- If sanctions on Venezuela are eased or lifted, Venezuelan crude may re-enter global markets.

- RIL, which operates the world’s largest refining complex at Jamnagar, could benefit from access to discounted Venezuelan crude, possibly priced $5–8 per barrel below Brent crude.

- Cheaper crude feedstock can improve refining margins, supporting profitability in RIL’s core energy business.

Analysts note that RIL’s scale and flexibility allow it to quickly adapt its crude sourcing strategy, giving it an edge over global peers.

ONGC’s Venezuela Exposure Comes into Focus

ONGC’s overseas arm, ONGC Videsh, has long-standing investments in Venezuelan oil fields. However, due to sanctions and operational challenges, ONGC has reportedly been unable to receive dividends worth nearly $500 million.

Analysts believe that:

- A change in Venezuela’s political or sanctions landscape could allow ONGC to recover pending dues.

- Improved operational clarity may help unlock value from ONGC’s overseas assets.

This optimism played a key role in ONGC’s sharp rally, as investors factored in the possibility of long-pending cash flows becoming accessible.

Oil Prices: Short-Term Spike, Long-Term Uncertainty

Crude oil prices reacted cautiously to the news. While geopolitical tensions usually push oil prices higher due to supply risks, analysts warn that the medium-term impact could be different.

- If Venezuelan production ramps up significantly, global oil supply could increase, potentially putting downward pressure on crude prices.

- This scenario may benefit refiners like RIL but could cap upside for upstream producers such as ONGC.

Market experts believe oil prices will remain volatile, driven by geopolitical headlines rather than fundamentals alone.

What Analysts Are Advising Investors

Brokerages are urging investors to remain selective and cautious:

- Short-term sentiment is clearly positive for oil-linked stocks.

- RIL remains a preferred pick due to its diversified earnings, strong balance sheet, and refining advantage.

- ONGC’s rally is sentiment-driven, and sustained upside will depend on actual developments regarding Venezuela and crude prices.

Analysts stress that while geopolitical events can trigger sharp market moves, long-term investment decisions should be based on fundamentals, earnings visibility, and balance-sheet strength.

Conclusion: Opportunity with a Watchful Eye

The rally in RIL and ONGC shares highlights how global geopolitical events can quickly influence Indian markets, especially sectors linked to commodities like oil and gas.

While investors are optimistic about potential benefits from changes in Venezuela’s oil landscape, experts caution that uncertainty remains high. Any escalation or reversal in global politics could swiftly alter market sentiment.

For now, RIL’s record high and ONGC’s strong jump reflect optimism, but investors would do well to keep a close watch on global crude trends and official developments from the US and Venezuela.