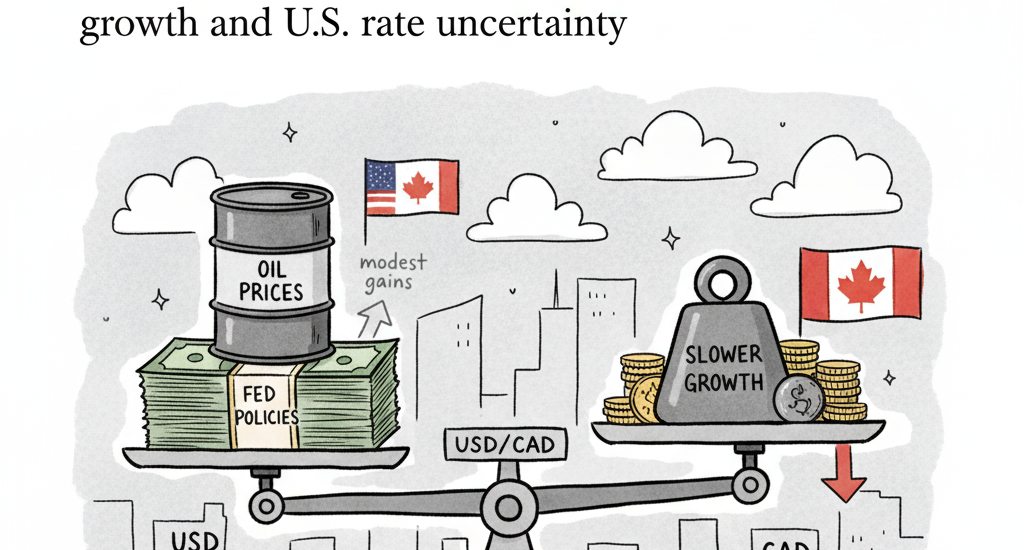

In the ever-volatile world of foreign exchange, traders and investors are constantly looking for clues about currency direction — and Rabobank’s latest outlook for the U.S. dollar to Canadian dollar (USD/CAD) pair has given markets something to talk about. According to the bank, the pair could drift down toward 1.36 in the next six months, signaling a possible strengthening of the Canadian dollar (CAD) against its U.S. counterpart.

As a stock and currency analyst, I find this prediction particularly interesting because it touches on several key themes shaping global markets — interest rate shifts, oil prices, trade relations, and the broader macroeconomic health of North America. Let’s unpack what’s behind Rabobank’s forecast and what it means for traders, investors, and businesses exposed to the Canadian economy.

1. The Big Picture: A Pair at the Crossroads

The USD/CAD pair has hovered above 1.41 recently, reflecting a prolonged phase of U.S. dollar dominance. The greenback’s resilience stems from stronger U.S. economic data, cautious Federal Reserve policies, and its safe-haven appeal amid global uncertainty.

. A combination of soft domestic growth, slowing consumer demand, and cooling housing activity has weighed on sentiment.

Yet, Rabobank’s latest analysis suggests a turning point may be on the horizon. The bank expects a gradual downward shift toward 1.36 in the coming months, meaning that the Canadian dollar could strengthen modestly against the U.S. dollar as certain economic forces begin to realign.

2. Interest Rate Dynamics: The Core Driver

One of the central reasons for Rabobank’s forecast is the narrowing interest rate differential between the U.S. and Canada.

The Bank of Canada (BoC) has likely reached the end of its rate-cutting cycle, signaling a pause as inflation stabilizes and the economy seeks balance. Meanwhile, the U.S. Federal Reserve — which has held rates higher for longer to combat inflation — is expected to begin easing monetary policy in early 2025.

This shift could erode the yield advantage that has supported the U.S. dollar over the past year. When interest rate differentials narrow, investors who once favored the higher-yielding currency — in this case, the U.S. dollar — tend to rebalance portfolios toward alternatives like the Canadian dollar.

As a result, Rabobank believes the USD/CAD rate could face downward pressure, particularly if the Fed’s first rate cuts coincide with a stabilizing Canadian economic outlook.

3. The Canadian Economy: Weak, But Not Broken

While Canada’s economy is currently facing headwinds, it’s important to note that not all indicators are negative. Yes, GDP growth has slowed, and consumer sentiment has softened. But the underlying fundamentals — particularly labor market stability, energy exports, and trade diversification — remain supportive in the medium term.

Canada’s dependence on energy exports, especially crude oil and natural gas, plays a key role in shaping the loonie’s performance. Historically, the CAD tends to strengthen when oil prices rise because higher energy revenues support government finances and boost foreign investment inflows.

With global energy demand expected to firm up in 2025 amid gradual economic recovery in China and Europe, the commodity-linked Canadian dollar could benefit — especially if crude prices stay above $80 per barrel.

However, Rabobank cautions that near-term gains might be limited. Until domestic growth rebounds and exports pick up, the CAD’s path to recovery may be slow and uneven.

4. Trade Relations: The Silent Influence

Another subtle but significant factor in Rabobank’s outlook is the U.S.–Canada trade relationship. Ongoing negotiations and trade policy uncertainty have weighed on Canada’s outlook, particularly as both nations reassess supply chains and cross-border agreements.

For now, trade volumes remain robust, but any friction or tariffs could temper confidence in the loonie. Rabobank’s analysts believe that while these challenges are unlikely to derail the currency entirely, they could keep USD/CAD range-bound between 1.34 and 1.36 in the short term.

This range-bound forecast reflects the broader sentiment in the market — cautious optimism but no expectation of dramatic moves unless a major macroeconomic shift occurs.

5. Technical Outlook: Patience Pays

From a technical analysis standpoint, USD/CAD has faced stiff resistance near 1.41–1.42, a level that has historically capped upside moves. On the downside, 1.36 remains a critical support level, aligning closely with Rabobank’s six-month forecast.

Traders watching this pair should pay close attention to central bank commentary, employment data, and oil price movements. A breakout below 1.36 could open the door to further CAD gains, while a rebound above 1.40 would suggest renewed U.S. dollar strength.

In short, the market seems to be in “wait and see” mode, with both currencies looking for clear directional cues.

6. Broader Implications: Lessons for Investors

For investors, Rabobank’s forecast provides valuable insight into cross-market linkages. The Canadian dollar isn’t just a currency — it’s a barometer of North American trade health, global oil demand, and risk sentiment.

Here are a few lessons investors can draw:

Diversification matters: Currency fluctuations can impact global portfolios, especially for those holding energy or commodity stocks. Hedging against USD/CAD volatility could protect returns.

Watch the Fed-BoC gap: Any unexpected policy move by either central bank could shift market sentiment quickly.

Energy correlation remains strong: A sustained rise in oil prices could give the loonie more traction than interest rate changes alone.

For long-term investors, a stronger CAD could benefit Canadian equities and energy exporters, while U.S. multinationals might face mild headwinds from a softer dollar.

7. The Human Element: Balancing Expectation and Reality

One thought on “Rabobank’s USD/CAD Forecast: Why the Loonie Could Gain Ground in 2025 Despite Near-Term Challenges”

Comments are closed.