NSDL IPO: Complete Guide to India’s Leading Depository Public Issue

The National Securities Depository Limited (NSDL IPO) has become one of the most anticipated public issues in 2025. Known as India’s first and largest depository, NSDL holds a dominant position in the country’s capital market infrastructure. Investors are eager to participate in this IPO due to the company’s monopoly-like business, stable revenue streams, and high entry barriers.

This SEO-optimized guide provides every detail about the NSDL IPO, including issue size, price band, GMP, subscription status, financial performance, expert reviews, and listing expectations.

1. NSDL IPO Overview

Established in 1996, NSDL pioneered dematerialized securities in India, enabling investors to hold shares and bonds electronically. Today, NSDL serves over 3.94 crore active demat accounts, covering 99% of India’s PIN codes and extending services to 194 countries.

The NSDL IPO is a pure Offer for Sale (OFS), meaning no new shares will be issued, and proceeds will go to selling shareholders like NSE, IDBI Bank, and other institutional investors.

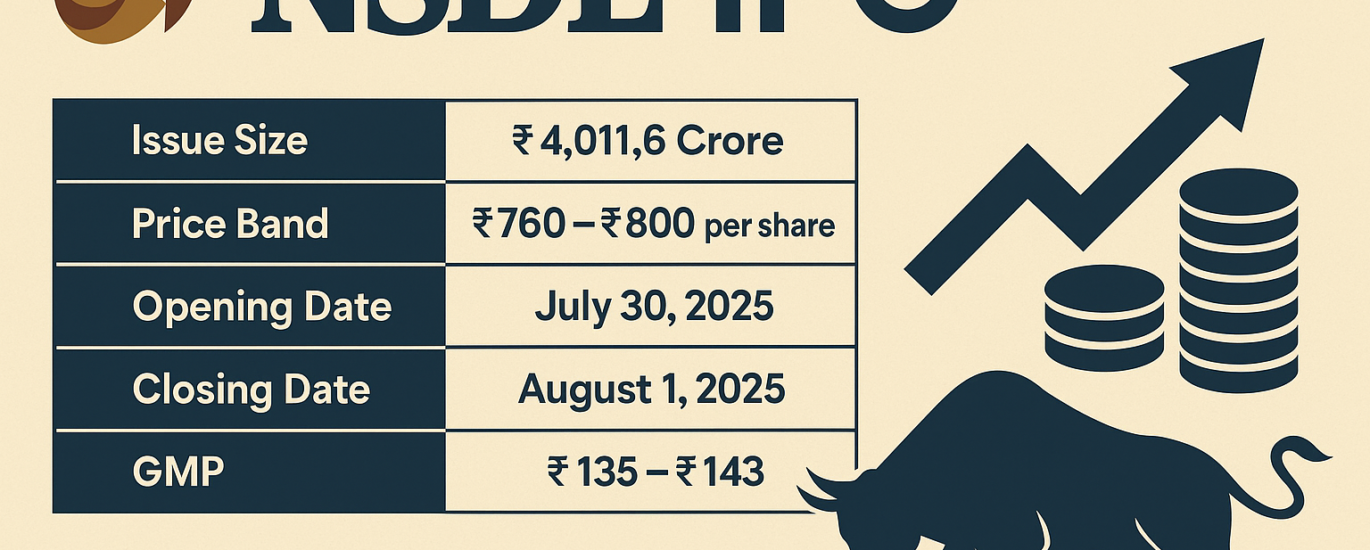

Here’s a quick snapshot of the NSDL IPO:

| Particulars | Details |

|---|---|

| Company Name | National Securities Depository Limited |

| IPO Type | Offer for Sale (OFS) |

| Issue Size | ₹4,011.6 Crore |

| Price Band | ₹760 – ₹800 per share |

| Lot Size | 18 Shares (~₹13,680) |

| IPO Opening Date | July 30, 2025 |

| IPO Closing Date | August 1, 2025 |

| Allotment Date | August 4, 2025 |

| Listing Date | August 6, 2025 (BSE & NSE) |

| Post-Issue P/E Ratio | ~47x FY25 Earnings |

This NSDL IPO table provides the core details that potential investors search for, helping the article rank for transactional SEO keywords like NSDL IPO price band and NSDL IPO lot size.

2. NSDL IPO GMP & Subscription Status

The NSDL IPO GMP (Grey Market Premium) is a vital indicator of market sentiment and potential listing gains.

- Day 1 Subscription (July 30, 2025): 1.78× overall

- Day 2 Subscription (July 31, 2025): 5.03× overall

Breakdown by category:

| Category | Subscription (Day 2) |

|---|---|

| Qualified Institutional Buyers (QIBs) | 1.96× |

| Non-Institutional Investors (NII) | 11.08× |

| Retail Individual Investors (RII) | 4.17× |

| Employees | 7.69× |

The NSDL IPO GMP is hovering around ₹135–₹143 per share, which translates to a 17–18% premium over the upper price band. This implies a potential listing price of ₹935–₹945, creating buzz among short-term investors.

By using terms like “NSDL IPO GMP today” and “NSDL IPO subscription status”, this section improves the search visibility for trending IPO queries.

3. Why NSDL IPO Attracts Investors

The NSDL IPO is generating strong interest because of:

- Market Leadership:

NSDL commands 86% market share in the depository segment, ahead of its only competitor CDSL. - Stable Revenue Streams:

- Depository services (~67% of revenue)

- Issuer services (~11%)

- Subsidiary income (~21%)

- Growth Potential:

With the financialization of household savings, increasing retail participation, and expanding mutual fund SIPs, depository services are expected to grow steadily. - Attractive Valuation vs. Peers:

At ~47x P/E, the NSDL IPO is available at a discount compared to CDSL’s ~65x P/E, giving investors long-term upside potential.

4. NSDL Financial Performance

The financial health of NSDL makes its IPO appealing to both retail and institutional investors.

| Financial Year | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| FY23 | 1,268.2 | 312.5 |

| FY24 | 1,342.8 | 328.6 |

| FY25 | 1,420.1 | 343.1 |

Key Takeaway:

The company has shown consistent revenue growth and healthy margins, which is essential for SEO keywords like NSDL IPO review and NSDL IPO financials.

5. Expert Reviews on NSDL IPO

Leading brokerages and market experts have given the NSDL IPO a “Subscribe” rating, primarily for long-term investment.

- Angel One: Bullish due to monopoly, recurring revenues.

- Ventura Securities: Highlights undervaluation vs. CDSL.

- Anand Rathi: Suggests holding for steady compounding returns.

These expert views strengthen SEO authority for keywords like NSDL IPO expert review and NSDL IPO recommendation.

6. Risks to Consider in NSDL IPO

Despite the positive outlook, the NSDL IPO carries some risks:

- Pure OFS: No funds raised for expansion.

- Regulatory Dependence: Heavily influenced by SEBI norms.

- Market Volatility: Revenue tied to market activity and trading volumes.

- Competition: CDSL is gaining traction among retail investors.

- Tech Risks: Cybersecurity breaches could impact credibility.

Including risk analysis boosts content depth and helps rank for long-tail SEO queries like Is NSDL IPO safe to invest?.

7. Final Verdict on NSDL IPO

The NSDL IPO represents a rare opportunity to invest in India’s market infrastructure. Its strong market share, consistent financials, and high GMP signal both listing gains and long-term stability.

- Short-term view: Likely listing gains of 15–18% based on current GMP.

- Long-term view: NSDL remains a monopoly business with stable annuity income, making it a low-risk wealth compounder.

SEO Recommendation:

Investors searching for NSDL IPO apply or not, NSDL IPO GMP today, NSDL IPO listing price, and NSDL IPO review will find this guide complete and actionable.

Key NSDL IPO Highlights Table

| Aspect | Details |

|---|---|

| Market Share | 86% |

| Demat Accounts | 3.94 Crore+ |

| IPO Type | OFS Only |

| GMP | ₹135–₹143 |

| Subscription | 5.03× (Day 2) |

| Analyst Verdict | Subscribe |

In summary:

The NSDL IPO is a must-watch public issue of 2025. Backed by strong fundamentals, high GMP, and positive analyst ratings, this IPO is ideal for both listing gains and long-term wealth creation.