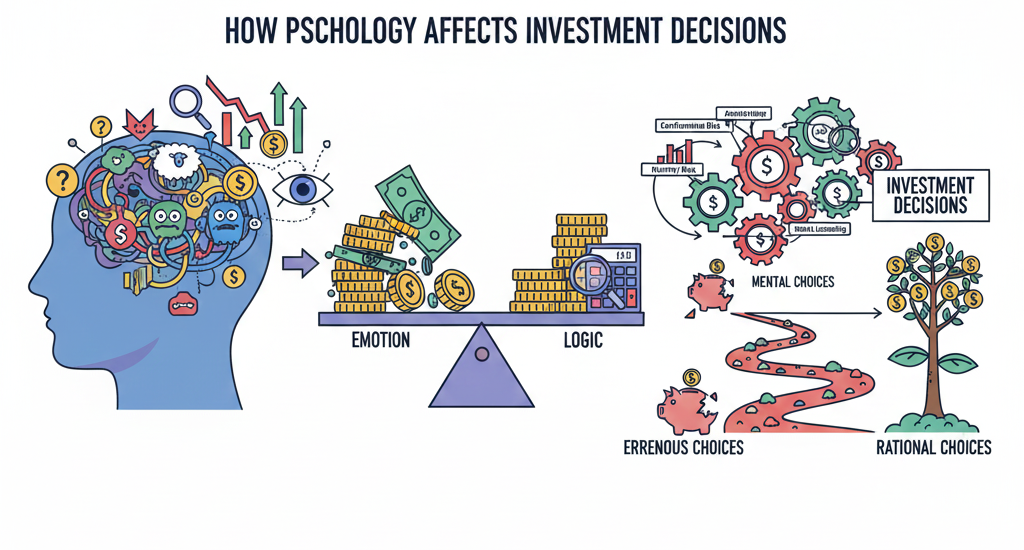

How Psychology Affects Investment Decisions. Behavioral finance is a field of study that explains how human psychology, emotions, and behavior influence financial decisions. Traditional finance theories assume that investors are rational, always make logical choices, and carefully analyze all available information before investing. However, real-life experience shows that investors often act emotionally and make decisions based on fear, greed, overconfidence, or social influence. Behavioral finance helps explain why people sometimes make irrational financial decisions and why markets do not always behave as expected.

At the core of behavioral finance is the idea that humans are not perfect decision-makers. Instead of carefully evaluating risks and returns, people often rely on mental shortcuts or past experiences when making financial choices. These shortcuts may save time, but they can also lead to mistakes. For example, an investor might buy a stock simply because it has performed well in the past, without properly analyzing whether it is still a good investment. Behavioral finance studies such patterns to understand how psychological factors affect financial behavior.

One of the most important aspects of behavioral finance is the role of emotions in decision-making. Emotions such as fear and greed strongly influence investor behavior. Fear can cause investors to sell their investments during market downturns, even when holding them might be the better long-term decision. On the other hand, greed can push investors to take excessive risks during market booms, leading them to invest in overpriced assets. These emotional reactions often result in poor timing decisions, such as buying at market highs and selling at market lows.

Behavioral finance also focuses on cognitive biases, which are systematic errors in thinking that affect judgment and decision-making. One common bias is loss aversion. Loss aversion refers to the tendency of people to feel the pain of losses more strongly than the pleasure of gains. Because of this, investors may hold on to losing investments for too long, hoping they will recover, rather than accepting a loss and moving on to better opportunities. This behavior can negatively impact long-term investment performance.

Another important bias studied in behavioral finance is overconfidence. Overconfident investors believe they have superior knowledge or skills compared to others. This can lead them to trade too frequently, underestimate risks, or invest heavily in a small number of assets. Overconfidence often results in higher transaction costs and increased exposure to risk, which can reduce overall returns. Many investors fail to realize that markets are unpredictable and that even experts can make mistakes.

Anchoring is another psychological bias that affects financial decisions. Anchoring occurs when investors rely too heavily on the first piece of information they receive, such as the original purchase price of a stock. For example, an investor may refuse to sell a stock below the price they paid for it, even if the company’s future prospects have weakened. This attachment to a reference point can prevent investors from making objective decisions based on current information.

Herd behavior is also a key concept in behavioral finance. Herd behavior occurs when individuals follow the actions of a larger group, often without conducting their own analysis. In financial markets, this behavior can be seen during market bubbles and crashes. When many investors buy an asset simply because others are buying it, prices can rise far above their true value. Similarly, panic selling during market downturns can cause sharp declines. Herd behavior explains why markets sometimes move in extreme and irrational ways.

The collective impact of these psychological biases and behaviors can lead to market inefficiencies. Traditional finance theories suggest that markets are efficient and reflect all available information. Behavioral finance challenges this idea by showing that investor behavior can cause prices to deviate from their true value. Market bubbles, sudden crashes, and prolonged periods of mispricing are often the result of emotional decision-making and widespread behavioral biases.

Behavioral finance also highlights the limitations of purely mathematical and theoretical models in finance. While traditional models are useful, they often fail to account for human behavior. Behavioral finance adds a more realistic perspective by recognizing that investors are influenced by emotions, social factors, and personal experiences. This makes behavioral finance an important tool for understanding real-world market behavior.

Understanding behavioral finance is valuable not only for economists and financial professionals but also for individual investors. By becoming aware of common biases and emotional traps, investors can improve their decision-making process. For example, recognizing the tendency to panic during market declines can help investors stay calm and stick to their long-term investment plans. Awareness of overconfidence can encourage investors to diversify their portfolios and manage risk more effectively.

Behavioral finance also plays an important role in financial planning and advisory services. Financial advisors use insights from behavioral finance to help clients make better decisions. By understanding a client’s emotional responses to risk and loss, advisors can design investment strategies that align with both financial goals and psychological comfort levels. This personalized approach can lead to better investment outcomes and greater client satisfaction.

In conclusion, behavioral finance provides a deeper understanding of how psychological factors influence financial decisions and market behavior. It explains why investors do not always act rationally and why markets sometimes behave unpredictably. By studying emotions, biases, and human behavior, behavioral finance offers valuable insights that complement traditional financial theories. For investors, understanding behavioral finance can lead to better decision-making, improved discipline, and long-term financial success.