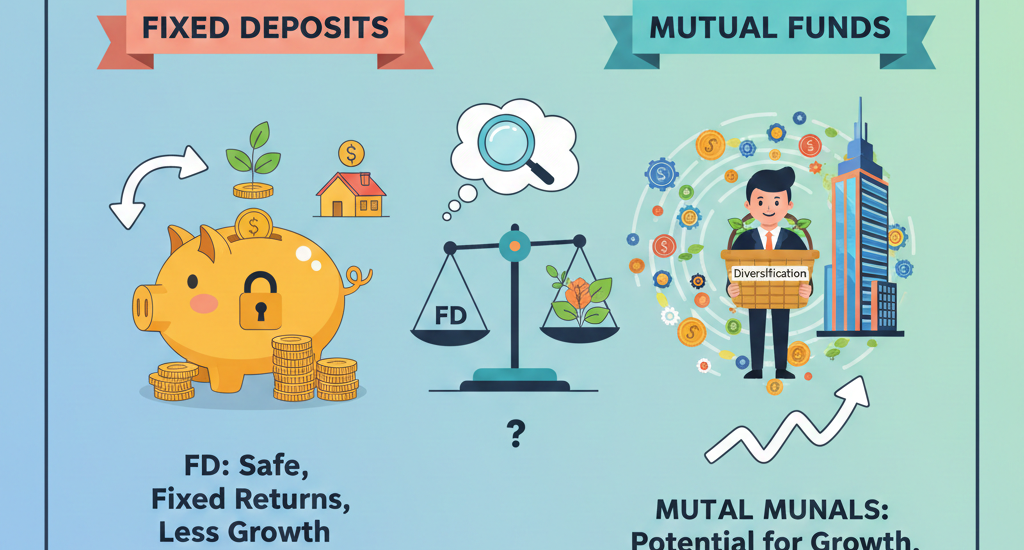

When it comes to saving and investing money, two of the most common options that people compare are Fixed Deposits (FDs) and Mutual Funds. At first glance, both appear safe and useful, but the truth is that they serve different purposes and work very differently. Understanding these differences helps you make better financial decisions based on your goals, time frame, and risk comfort.

What is a Fixed Deposit?

A Fixed Deposit is a type of investment offered by banks and some financial institutions. You deposit a certain amount of money for a specific period such as one, three or five years, and the bank promises to pay you a fixed interest rate throughout that time. Your return doesn’t change even if market conditions change.

People who prefer safety and guaranteed returns find Fixed Deposits appealing. Your capital is generally protected, and unlike market-linked instruments, you don’t see fluctuations in your money value. Although the interest rates may differ from bank to bank, the return is known in advance, which gives a sense of security.

What are Mutual Funds?

Unlike FDs, Mutual Funds are investment products that collect money from many investors and invest it into a diversified portfolio, which may include shares, government bonds, corporate bonds or other securities. The type of returns you receive in a mutual fund depends on how those underlying assets perform.

Mutual funds do not promise a fixed return. However, over a longer duration, certain types of funds—especially equity funds—have historically provided higher growth because they are linked to market performance. Investors can begin with either a lump sum or smaller regular payments called SIPs, which makes this investment convenient for beginners as well.

Return Potential and Risk Differences

One of the major differences between FDs and Mutual Funds is how returns are generated. Fixed Deposits give you a clearly known maturity amount, which is attractive if you dislike uncertainty. Mutual Funds, however, can fluctuate in value depending on market conditions. This means the returns may be higher, or lower, depending on what happens in the market during your investment period.

Safety in FDs is comparatively high. With mutual funds, the level of risk depends on which type of fund you invest in. Equity funds carry more risk because they depend on stock market movement, while debt funds invest in fixed income instruments and therefore carry relatively lower risk.

If someone is investing for only a short period and needs guaranteed returns, FDs seem like the safer option. But if the goal is long-term wealth creation, mutual funds may be more suitable because the potential long-term return is higher than Fixed Deposits.

Liquidity and Flexibility

Another important difference is how easily you can access your money. The money invested in a Fixed Deposit is locked for a specific tenure. Withdrawing earlier may be allowed, but the bank usually charges a penalty or offers lower interest, which reduces returns.

On the other side, most mutual funds are more flexible because you can withdraw money whenever needed, subject to fund rules. You may face an exit load in some cases if you withdraw too soon, but generally, they are considered more liquid than Fixed Deposits.

Mutual Funds also give flexibility in investing. You don’t need a large amount to start. Even a small SIP amount invested regularly can grow into a significant amount over time.

Taxation and Real Returns

Taxation also plays a big role in deciding which investment is better. Interest from FDs is added to your total income and taxed based on your income tax slab. This means people in higher income brackets end up paying more tax on FD interest, reducing the final return.

Mutual funds are taxed differently depending on how long they are held. For longer holding periods, the tax on long-term gains is generally lower than the tax on FD interest. Over time, this can mean mutual funds give better post-tax returns than FDs.

Also, inflation must be considered. Since FD rates are sometimes lower than inflation, the real value of your money can reduce after maturity. Mutual funds, especially equity-oriented ones, historically tend to beat inflation in the long run.

What Should You Choose?

Your decision should be based on personal financial goals, how long you want to invest, and how much risk you are willing to take.

Choose Fixed Deposits if:

you want guaranteed and safe returns

you don’t want the value of your investment to fluctuate

you are investing for the short or medium term

you are uncomfortable with market risks

you prefer certainty rather than chasing higher returns

Choose Mutual Funds if:

your goal is long-term wealth creation

you want higher potential returns

you are comfortable with market movements

you want flexibility, liquidity and tax efficiency

you can invest for several years

For many people, a balanced approach works best. Some part of money stays in FDs for stability and safety, while another part may be directed to mutual funds for long-term growth.

Final Thoughts

FDs and Mutual Funds are both useful investment tools, but they serve different needs. Fixed Deposits offer security, predictability, and peace of mind. Mutual Funds offer flexibility, tax advantages, and the possibility of higher returns over time.

If you want to stay safe and earn steady interest, Fixed Deposits might be the right choice. If you want your money to grow and you can tolerate some market fluctuation, Mutual Funds could be the more rewarding option in the long run.

The best strategy is often to combine both in a way that matches your financial goals, time horizon, and comfort with risk.