The foreign exchange market is a labyrinth of trends, economic data, and geopolitical events, and for those looking to trade the euro against the U.S. dollar (EUR/USD), understanding the current market dynamics is crucial. Over the past few weeks, the euro has been regaining strength against the U.S. dollar, driven by a combination of technical factors and evolving economic sentiment. In this article, we’ll take a deep dive into the current state of the EUR/USD pair, the forces at play, and the outlook for traders and investors as they navigate these waters.

Current Market Overview: A Resilient Euro

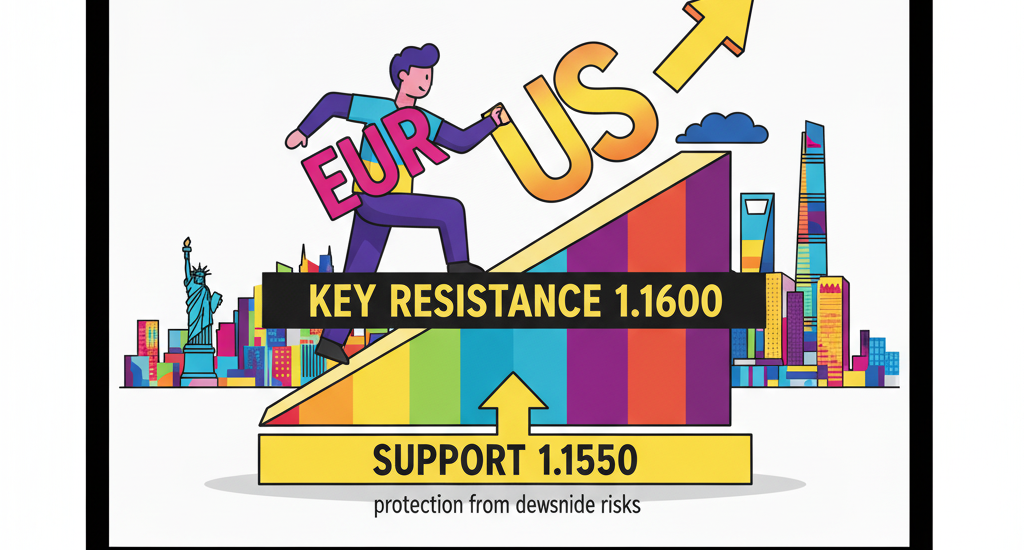

EUR/USD, the most widely traded currency pair in the world, is a barometer for global economic sentiment. After months of fluctuating between a range of levels, the euro has managed to stage a recovery against the dollar. As of the latest market updates, the pair is hovering near the crucial resistance level of 1.1600, which has sparked the interest of many market watchers. For investors and traders alike, this level represents a critical point for determining whether the current bullish trend will continue or face a potential reversal.

Technical Indicators Suggest a Bullish Momentum

One of the most telling aspects of the current EUR/USD price action is the bullish momentum visible on various technical indicators. The Moving Average Convergence Divergence (MACD) is flashing positive signals, suggesting that the pair could see further upward movement if the momentum sustains. Traders often look at MACD as a reliable tool for identifying trend reversals and confirmations. In this case, the MACD’s positive divergence implies that the bulls are in control, at least for the short-term.

Additionally, the Relative Strength Index (RSI), a widely used momentum oscillator, is approaching the 60-70 range, signaling that the pair is neither overbought nor oversold, leaving room for potential upside. RSI readings above 70 typically indicate an overbought condition, while readings below 30 suggest oversold conditions. Right now, EUR/USD’s position indicates room for further bullish movement without the risk of an immediate correction.

Resistance at 1.1600: Key Level to Watch

Traders should closely monitor the 1.1600 level as it marks a significant resistance point. A break above this level could trigger a surge towards the next major resistance at 1.1620. The 1.1600-1.1620 range is a critical zone, as it is where the pair faced previous selling pressure, and any breakout here could signal the beginning of a new uptrend.

The importance of 1.1600 cannot be overstated. It is a psychological barrier as well as a technical one. If the euro manages to close above this level on a daily chart, it would indicate that the bulls have gained enough momentum to push the pair higher. For traders, this would be the signal to adjust positions, potentially moving into long trades to capitalize on the continuation of the bullish trend.

On the flip side, if the euro fails to break above 1.1600 and begins to retrace, we could see a test of support levels around 1.1550. This support level, which has held firm in recent trading sessions, will be crucial for maintaining the current trend. If it breaks, traders may need to reassess their positions and prepare for further downside risk.

Support Levels: Protecting the Uptrend

While resistance levels often capture the spotlight, support levels are just as important in forecasting potential price action. As the EUR/USD pair moves upwards, support levels play a key role in protecting the bullish momentum. Currently, support is found near the 1.1550 mark. This level has proven to be a cushion for the pair, preventing it from slipping back into a bearish trend.

Should the price fall toward this level, a bounce off 1.1550 would reinforce the idea that the uptrend is intact. However, if the support fails, it could signal a reversal or at least a pause in the current rally. In such a case, the next support level to watch would be around 1.1500, followed by 1.1450.

The key takeaway here for traders is the importance of managing risk. For those looking to enter long positions, it’s crucial to place stop-loss orders just below 1.1550 to safeguard against a potential breakdown. On the other hand, short traders would be wise to wait for confirmation of a breakdown below 1.1550 before entering any trades.

Economic Data and Central Bank Policies: Major Drivers of EUR/USD

The EUR/USD exchange rate is heavily influenced by economic data, particularly from the European Central Bank (ECB) and the Federal Reserve. The contrasting monetary policies of the ECB and the Fed play a significant role in shaping the outlook for the euro and the dollar.

On the ECB front, the central bank has been maintaining a relatively dovish stance, especially in comparison to the Fed’s aggressive tightening measures over the past year. While the ECB has raised interest rates to combat inflation, the Fed’s policy actions have been more aggressive, making the dollar stronger in the process. The ongoing divergence in central bank policies has contributed to the euro’s recent struggles but also provides a window of opportunity for a recovery as market expectations around U.S. rate hikes begin to stabilize.

The upcoming U.S. economic data releases, including employment figures, inflation reports, and GDP growth estimates, will be critical in determining whether the dollar continues to hold its ground or if the euro can capitalize on any potential U.S. economic weakness. Any signs of a slowdown in the U.S. economy or a more dovish Fed stance could weigh on the dollar, providing further support for the euro.

Geopolitical Factors to Consider

In addition to economic factors, geopolitical events can also influence the EUR/USD pair. European markets, in particular, are sensitive to political developments within the Eurozone. Issues such as trade policies, political stability, and regional elections can all cause volatility in the EUR/USD pair.

Recently, concerns over energy prices, particularly natural gas, have been a source of uncertainty in Europe. A prolonged energy crisis, or further supply disruptions, could put pressure on the euro and undermine its recent strength. However, if Europe manages to navigate these challenges and demonstrate resilience, the euro could maintain its bullish trend against the U.S. dollar.

Outlook for EUR/USD: What’s Next?

Looking ahead, the outlook for the EUR/USD currency pair remains cautiously optimistic, provided that key levels of resistance and support hold. A break above 1.1600 would be a positive development for the bulls, signaling a potential continuation of the rally towards 1.1620 or higher. However, caution is warranted, as the U.S. dollar remains a formidable opponent, with the Fed’s monetary policy and U.S. economic data continuing to be major factors in determining the pair’s direction.

For traders, it’s essential to stay alert to developments from both the ECB and the Fed, as well as any shifts in the global economic landscape. Trading around key technical levels—such as 1.1600 and 1.1550—will be critical in managing risk and positioning for potential opportunities.

Conclusion

EUR/USD has shown impressive resilience, and with the current bullish momentum, there’s reason to be cautiously optimistic about the pair’s near-term prospects. While resistance at 1.1600 remains a critical hurdle, a successful breakout could pave the way for further gains. Conversely, if the pair falters, traders should keep a close eye on key support levels, particularly around 1.1550. As always, successful trading in the forex market requires a balanced approach, combining technical analysis with a keen awareness of macroeconomic and geopolitical events.

For traders, it’s not just about chasing the trend—it’s about understanding the broader market context and adapting strategies accordingly. Whether you’re a long-term investor or a short-term trader, the EUR/USD currency pair presents both challenges and opportunities in equal measure.

2 thoughts on “EUR/USD Price Forecast: Navigating the Euro’s Bullish Momentum”

Comments are closed.