In a global economy still feeling the aftershocks of inflation and monetary tightening, central banks are treading cautiously between fostering growth and maintaining price stability. The Czech National Bank (CNB) has now joined this delicate balancing act, signaling a firm commitment to keeping rates steady amid elevated core inflation.

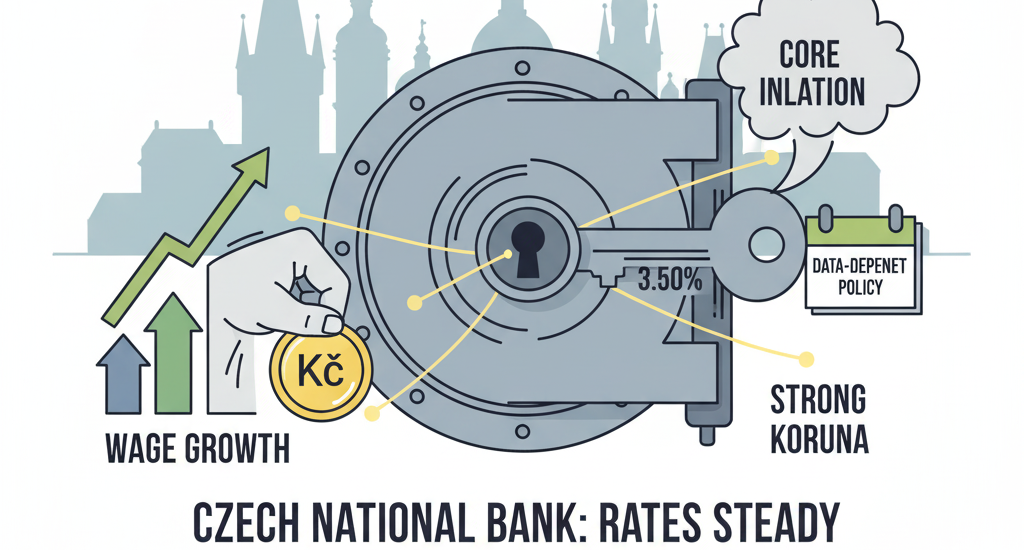

As a market observer and stock analyst, I see this decision not merely as a domestic policy stance but as a reflection of broader regional and global trends—where inflation’s persistence is challenging central banks’ resolve to pivot toward easing. The CNB’s focus on rate stability at 3.50% is a prudent, data-driven response to an economy that remains vulnerable to price and wage pressures.

Inflation’s Shadow Still Looms Over the Czech Economy

The CNB’s key takeaway is clear: inflation in the Czech Republic has moderated from its peaks, but it hasn’t cooled enough to justify a rate cut. The more stubborn component—core inflation—remains elevated. Unlike headline inflation, which fluctuates with energy and food prices, core inflation captures persistent price trends in services and labor.

This stickiness in prices, especially within the services sector, is being driven by rising wages and strong consumer demand. Wage growth in the Czech Republic has accelerated beyond productivity gains, increasing the risk of second-round inflationary effects. Essentially, as workers demand higher pay to offset past inflation, companies raise prices to maintain profit margins, feeding a cycle of sustained inflation.

For the CNB, this means caution. Even as global commodity prices ease and supply chains normalize, domestic inflationary dynamics remain a concern. The central bank’s latest communication underscores its focus on preventing premature policy easing that could undo the progress made in bringing inflation down.

Why the CNB Is Choosing Rate Stability Over Aggressive Cuts

Investors and analysts were watching closely for any hints of a rate cut. However, the CNB has signaled that holding steady is the best course of action for now. This restraint stems from several intertwined factors:

- Persistent Core Inflation:

Despite improvement in headline figures, the underlying inflation trend remains above the bank’s comfort zone. The CNB cannot risk loosening policy when inflation expectations haven’t fully anchored back to target. - Wage Pressures:

The Czech labor market remains tight, with unemployment among the lowest in Europe. Rising wages continue to feed into service-sector inflation, making it difficult for the CNB to declare victory over inflation. - Currency Considerations:

The Czech koruna has remained relatively firm, supported by the CNB’s cautious stance. Any premature easing could weaken the currency, leading to imported inflation through higher import costs. - External Monetary Dynamics:

The European Central Bank (ECB) and other major peers are also signaling caution, balancing the need to support slowing economies while keeping inflation anchored. The CNB’s alignment with this cautious tone reinforces its credibility and currency stability.

For equity markets, this decision signals continuity and predictability—two qualities that investors value. While high interest rates may cap short-term borrowing and spending, they also provide a foundation of monetary discipline that stabilizes investor confidence.

Forward Guidance: The CNB’s New Compass

The CNB has placed a strong emphasis on forward guidance, indicating that markets should pay attention to its upcoming economic forecast rather than expecting immediate policy shifts. This move reflects a sophisticated communication strategy that aims to manage investor expectations in an uncertain environment.

By anchoring its message around “data dependency,” the CNB effectively keeps all options open. If inflation begins to recede meaningfully and wage growth moderates, there may be room for rate cuts in the second half of next year. However, if core inflation remains sticky, the central bank will likely extend its restrictive stance longer than markets currently anticipate.

For stock investors, this signals that interest-sensitive sectors, such as real estate, banking, and consumer discretionary, may experience continued short-term pressure. However, defensive sectors like utilities, consumer staples, and healthcare could maintain stability amid steady monetary conditions.

How Investors Should Read CNB’s Decision

From an investment perspective, the CNB’s policy posture carries several implications:

- Banking Sector Outlook:

Higher interest rates are a double-edged sword for banks. On one hand, they support net interest margins; on the other, they slow credit demand. Czech banks have so far shown resilience, maintaining profitability thanks to conservative balance sheets and low default rates. A stable rate environment supports this equilibrium, offering steady earnings visibility. - Consumer Spending and Retail:

Elevated rates tend to dampen household spending, but the Czech consumer has remained surprisingly resilient. With wages rising and inflation expectations moderating, purchasing power is gradually stabilizing. However, if inflation persists, discretionary spending could remain under pressure. - Equity Valuations:

Stock market valuations across Central Europe have already priced in higher rates. The CNB’s signal of stability reduces uncertainty, which could attract renewed foreign interest—especially if the koruna remains strong and inflation moderates in the coming quarters. - Bond Markets:

For fixed-income investors, stable policy implies limited near-term volatility. Longer-dated Czech government bonds may benefit if inflation expectations ease, providing opportunities for modest capital appreciation.

Global Context: A Mirror of Broader Central Bank Trends

The CNB’s approach is in line with what we’re witnessing globally—caution in the face of lingering inflation. The Federal Reserve, the ECB, and the Bank of England have all adopted similar tones, emphasizing that rate cuts will only come once inflation data provides consistent evidence of cooling.

In many ways, the CNB’s challenge is magnified by its smaller, open economy. The Czech Republic is highly integrated with the European Union, and global supply shocks or commodity fluctuations quickly ripple through its system. A stable interest rate serves as both a shield and a signal—shielding against volatility and signaling the bank’s credibility to markets and investors.

The Czech Koruna: A Quiet Beneficiary

The CNB’s firm stance on rates also indirectly supports the Czech koruna (CZK). A stable or strong currency helps control imported inflation, keeping energy and raw material costs in check. This, in turn, supports the CNB’s longer-term goal of achieving sustainable price stability.

Currency traders have taken note. The koruna’s relative strength has been one of the few bright spots in the Central European FX landscape, outperforming peers such as the Polish zloty and Hungarian forint at various points this year. If the CNB maintains its hawkish bias while others begin to ease, the CZK could retain its strength into 2025.

Risks Ahead: Economic Growth vs. Inflation

While the CNB’s cautious stance is understandable, the policy comes with trade-offs. Keeping rates high for too long could weigh on economic growth, corporate investment, and consumer sentiment. GDP growth in the Czech Republic has been modest, and prolonged monetary restriction could risk a slowdown in industrial output and domestic demand.

The challenge for policymakers will be timing the pivot—easing rates early enough to support growth without reigniting inflation. Investors should monitor data on wage growth, core inflation, and business sentiment as leading indicators of when the CNB might consider its first rate cut.

Conclusion: Stability Over Stimulus

In the current economic climate, the CNB’s decision to maintain rate stability is a signal of prudence, not paralysis. By keeping its policy rate steady and emphasizing forward guidance, the central bank is reinforcing its credibility in a complex inflationary environment.

For investors, the takeaway is clear:

- Expect continued monetary restraint in the short term.

- Focus on sectors resilient to high rates.

- Monitor inflation and wage data closely for signs of a potential shift in policy next year.

The Czech economy may not be roaring ahead, but it’s staying steady—and in today’s volatile global backdrop, steady often beats risky. The CNB’s decision underscores a central truth of modern monetary policy: when inflation refuses to fade quietly, patience becomes the most valuable asset in a policymaker’s toolkit.

In short, elevated core inflation supports CNB’s rate stability—and for investors, this stability offers both reassurance and a clear signal of where the Czech financial markets are headed next.