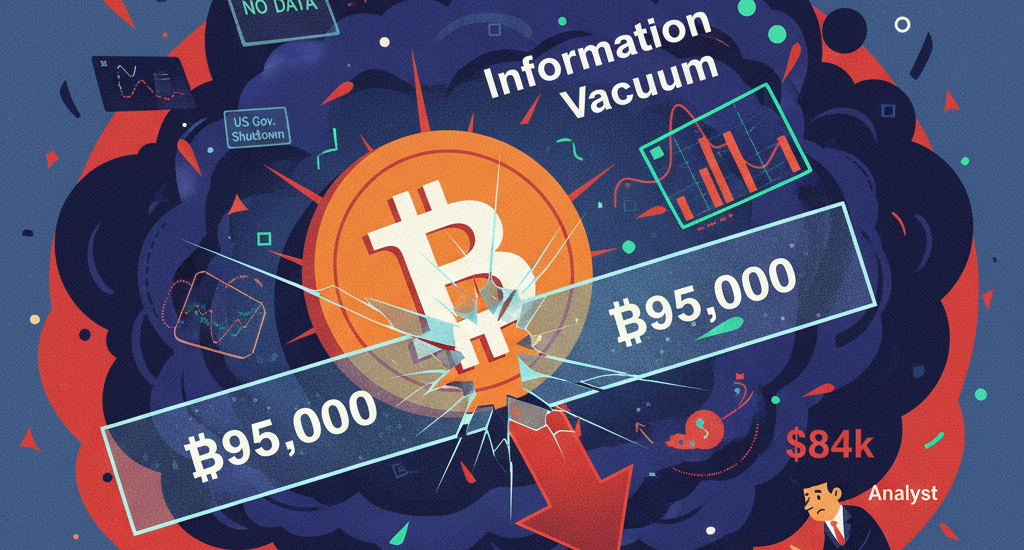

Bitcoin ($\text{BTC}$), the bellwether of the cryptocurrency world, concluded a brutal week of trading by plunging below the psychologically and technically significant $95,000 mark. The downturn was not a minor blip, but the cryptocurrency’s worst performance in eight months, dragging prices down to levels not seen since the spring. This severe correction has stripped the market of billions in value, forcing analysts to confront the uncomfortable reality that $\text{BTC}$’s short-term trajectory is being dictated less by its inherent fundamentals and more by a crippling combination of macroeconomic uncertainty and stark technical signals.

The current market malaise is a perfect storm where political gridlock in Washington meets fading expectations of immediate monetary easing from the Federal Reserve. As Bitcoin struggled to find a floor, analysts scrambled to redefine support levels, with one prominent chief investment officer setting a cautionary downside target that could see the asset slide further toward the $84,000 range. This moment serves as a painful but necessary market reset, flushing out weak hands and realigning expectations after a long period of hopeful, yet ultimately failed, consolidation.

The Anatomy of the Sell-Off: A Nine-Percent Plunge

The price action of Bitcoin over the past week was unambiguously bearish. The coin was on track to record a punishing 9% loss for the week, an alarming performance that represented its weakest showing since a major sell-off in March. By holding at session lows below $95,000, Bitcoin fell to its lowest valuation point since May.

Crucially, this collapse occurred even as major U.S. stock indices managed to cling to minor gains late in the trading day, highlighting a sharp decoupling where $\text{BTC}$ was significantly underperforming traditional risk assets. The crypto sector, which often takes its directional cues from the tech-heavy Nasdaq, was instead seeing its own concentrated pain.

This slide has had immediate, cascading effects on publicly traded crypto-related equities. Firms deeply invested in the $\text{BTC}$ ecosystem, such as MicroStrategy ($\text{MSTR}$), the largest public holder of the cryptocurrency, saw their stock slide another 4% to trade below $200—a level not breached since October of the previous year. Similarly, miners and other ecosystem players, including Bullish ($\text{BLSH}$), BitMine Immersion Technologies ($\text{BMNR}$), and CleanSpark ($\text{CLSK}$), all registered losses in the 4% to 7% range. The concentrated selling pressure underscores the market’s fragility and the reflexive nature of the digital asset space when momentum breaks.

Technical Alarm Bells: The $84,000 Downside Target

For seasoned traders, the move below the $95,000 psychological level was a severe blow, but the technical picture suggests the pain may not be over. John Glover, Chief Investment Officer at crypto lending firm Ledn, provided a sobering technical assessment, noting that the breakdown below a key level has opened the door for a much deeper correction.

Specifically, Glover highlighted the significance of the 23.6% Fibonacci retracement level, which sat just below the $100,000 mark. The failure to hold this level, which often acts as a pivot point in a trend, effectively cleared the path to the next major line of defense. According to Glover’s analysis, that key support level now sits firmly around $84,000.

This technical outlook frames the current market action as part of a larger, ongoing bear market correction. While Glover did suggest that a brief bounce back above $100,000 might occur before any sustained move below $90,000, his longer-term forecast anticipates volatile action that could see the full correction play out across the upcoming months. The market is now staring down a potential 11% further drop, making $84,000 the most critical price point to watch for anyone tracking the cryptocurrency’s health.

The Information Vacuum: Washington’s Impact on Crypto Confidence

While technical levels illuminate where the market is going, the primary explanation for why it is sliding lies squarely in the realm of macroeconomics and political uncertainty. Analysts from Bitfinex were vocal in identifying the core culprit behind the downturn: an “information vacuum” resulting from the U.S. government’s lengthy shutdown.

The cessation of government operations, which lasted from October 1st until the current date, meant that key economic data releases—specifically, inflation and jobs reports—were suspended. These reports are the lifeblood of modern financial markets, providing the essential clarity that guides investor confidence and, critically, directs the future path of Federal Reserve monetary policy.

As the Bitfinex analysts explained in their note, the market retracement is fundamentally “the result of an information vacuum and political uncertainty.” Without reliable data to signal the economy’s direction, both the market and the Federal Reserve are left standing by, unable to confidently determine if further rate cuts or easing measures are appropriate. In finance, this lack of knowledge is often more corrosive to confidence than outright bad news. The market despises uncertainty, and the data blackout created a dense fog of confusion.

Adding to the woes, the spending bill that ultimately ended the shutdown only provided temporary relief, funding the government until January 30, 2026. This stopgap measure only postponed the political uncertainty rather than resolving it, providing another clear reason for investors to de-risk and reduce their exposure to volatile assets like Bitcoin. The lack of political and economic clarity is, for now, the single most powerful headwind facing the crypto market.

A Necessary Flush Before the Next Rally

For some market observers, the recent drawdown, while painful, is not a cause for panic but a necessary step in the market’s cyclical health. Noelle Acheson, the author of Crypto Is Macro Now, characterized the move as a “necessary correction” after months of frustrating price action.

Throughout the previous period, Bitcoin had been trapped in a range-bound consolidation that ultimately failed to sustain a breakout above the ambitious $120,000 mark. Acheson suggests that the market needed to get through this period of selling—a “flush”—before it could regain the necessary structural integrity to move higher. “We need to get through this flush before we can breathe more easily,” she wrote, adding that “Once that happens, the longer-term case for $\text{BTC}$ strengthens—but we’re not there yet.”

The long-term case, Acheson added, remains anchored to macro liquidity. While the market has scaled back expectations for an immediate Fed rate cut, now perhaps expecting one no sooner than late in the first quarter of 2026, the potential for other easing measures remains. Expectations for balance sheet adjustments, liquidity injections, or broader monetary easing could help rebuild optimism around all risk assets, including $\text{BTC}$. However, until the current market instability and political uncertainty are fully resolved, and until the flush to new support levels is complete, that long-term optimism remains on hold.

In sum, the current slide below $95,000 is a complex confluence of technical signals and macroeconomic shadows. It is the result of a political failure creating an information void that has stifled confidence and accelerated technical breakdowns. As the market enters a period of heightened volatility, all eyes will be fixed not just on the charts, but on Washington, awaiting the essential data and political clarity required for Bitcoin to finally stabilize and begin charting a course toward its next sustained rally, ideally finding solid footing around the $84,000 support level.

One thought on “Beneath the $95K Floor: Bitcoin’s Worst Week Since March Signals a Macro-Driven Market Reset”

Comments are closed.