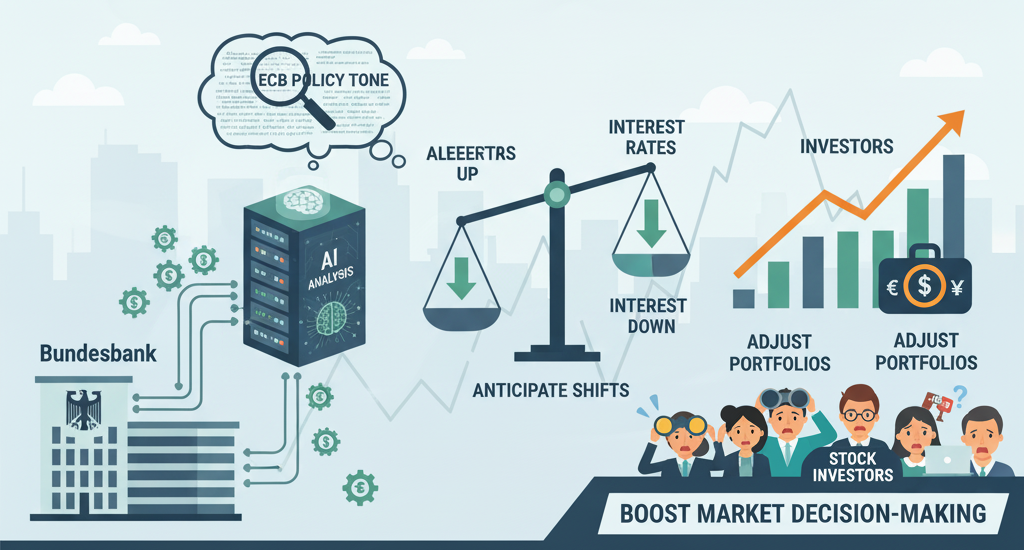

In the evolving world of finance, technology continues to make waves. One of the most recent and intriguing developments comes from Germany’s central bank, the Bundesbank, which has adopted Artificial Intelligence (AI) to track the tone of statements made by policymakers in relation to monetary policy. While this may seem like a small shift, it could have far-reaching implications, particularly for stock market investors who rely on accurate forecasts and insights into central bank actions. This shift marks a fascinating convergence between traditional monetary policy analysis and cutting-edge technology, offering investors an invaluable new tool to predict future policy shifts.

AI and the Dovish-Hawkish Debate

The primary purpose behind the Bundesbank’s move is to use AI to assess whether policymakers are leaning more towards a dovish or hawkish stance. For those unfamiliar with these terms, a dovish approach refers to a monetary policy that favors lower interest rates and stimulative measures to foster economic growth. On the other hand, a hawkish stance typically involves advocating for higher interest rates to combat inflation, even at the risk of slowing down economic activity.

In central banking, these opposing views often create a fine balance, particularly within the European Central Bank (ECB), where policymakers must navigate the needs of 19 different economies within the Eurozone. The problem is that verbal cues about policy direction can be quite subtle, and interpreting the tone of statements made by central bankers can often be subjective. One official might phrase their comments cautiously, while another might be more direct or assertive. This is where AI comes into play.

Using advanced AI algorithms, the Bundesbank’s new tool is designed to scan and assess the language used by ECB officials. By quantifying the tone of their remarks—whether optimistic, cautious, or hawkish—the AI tool provides an objective, data-driven analysis of the overall sentiment within the ECB. This allows the Bundesbank to gain a clearer picture of the ECB’s intended direction in its monetary policy.

Why Does This Matter for Investors?

For stock market investors, understanding the monetary policy stance of the ECB is crucial. The European Central Bank controls one of the most influential levers in the global economy—interest rates. Interest rates directly affect corporate profitability, consumer spending, and investment strategies. The higher the rates, the more expensive it becomes to borrow money, which can slow economic activity. Conversely, lower rates tend to encourage borrowing and investment, stimulating growth.

Thus, stock market investors, especially those in European markets, closely watch the ECB’s policy decisions. However, interpreting the signals from the central bank is not always easy. Official policy changes are typically made in press releases or at scheduled meetings, but the comments made by officials between these announcements often provide key clues. A subtle shift in tone—such as a slight change in language or rhetoric—could indicate a change in policy direction. For instance, if an ECB official begins using more hawkish language, it could signal an interest rate hike, which may cause stocks to fall.

The new AI tool from the Bundesbank can now help investors interpret these clues more objectively, improving their ability to anticipate moves by the ECB. By analyzing how policymakers’ statements are framed—whether they’re leaning towards tighter or looser monetary conditions—the AI tool helps investors gain insights into future rate hikes or cuts, inflation concerns, and the overall health of the Eurozone economy.

The Market Implications of AI-Powered Policy Insights

So, how will this AI-driven analysis impact the stock market? Let’s break it down:

1. Better Anticipation of Policy Shifts

As the Bundesbank uses this AI tool to assess the policy tone of ECB officials, stock market participants can gain more clarity on the likely direction of monetary policy. If the tool consistently detects a shift towards a more dovish stance, it could signal that the ECB is likely to keep interest rates low for longer. Conversely, if the AI detects a hawkish tilt in statements, markets may begin pricing in the possibility of rate hikes. For investors, early access to this type of information could provide a significant advantage in adjusting their portfolios in response to evolving policy expectations.

2. Enhanced Decision-Making

Stock investors—especially those focused on European equities—will be able to make better-informed decisions based on a more accurate reading of central bank sentiment. Investors who are able to accurately predict the ECB’s monetary policy actions may be able to position themselves in sectors that are more likely to benefit from certain policy shifts. For example, a dovish stance (i.e., low interest rates) would likely benefit growth stocks, particularly in sectors such as technology, which rely on easy access to capital. On the other hand, hawkish rhetoric might drive investors to favor value stocks or those in defensive sectors like utilities.

3. Improved Risk Management

A central tenet of investing is managing risk, and one of the most effective ways to mitigate risk is by anticipating potential shifts in the macroeconomic environment. With the AI tool providing clearer insights into ECB policy tone, investors can adjust their portfolios to manage risk better. For example, if the AI signals a shift towards tightening monetary policy, investors might reduce their exposure to highly leveraged stocks, as these companies are more sensitive to interest rate increases. Similarly, they may allocate more funds to companies that can benefit from a higher rate environment, such as banks, which typically perform better when interest rates rise.

4. Global Spillover Effects

While the Bundesbank’s AI tool focuses on ECB policy, its influence goes beyond just Germany or the Eurozone. The European Central Bank has a significant impact on global markets. Interest rate changes or shifts in sentiment at the ECB often have repercussions in global markets, particularly in the currency markets, commodities, and emerging markets. A hawkish shift in ECB policy could strengthen the euro, leading to a more challenging environment for companies that export goods to the Eurozone. Conversely, a dovish stance could weaken the euro, benefiting European exporters. The AI tool, by providing clearer signals about ECB policy shifts, allows investors to anticipate these global spillovers, thus refining their strategies in international markets.

5. Transparency and Trust in Central Bank Communications

This AI-powered tool also brings an element of transparency to central bank communications. Historically, interpreting the language of central bankers has been both an art and a science—where financial analysts often had to rely on subjective interpretations of tone. With AI, investors have access to a more consistent, systematic analysis of these statements, which could lead to greater confidence in market predictions. For those with an interest in European markets, this increased transparency can help build trust in the decision-making processes of central banks, providing more stability for long-term investors.

The Future of AI in Central Banking

While the Bundesbank’s AI tool is a pioneering step in the use of technology to track monetary policy sentiment, this could just be the beginning. Central banks around the world could begin adopting similar AI-driven tools to analyze and forecast policy shifts. The increased reliance on data-driven insights could enhance the transparency and effectiveness of central banking, ultimately benefiting financial markets by providing more accurate predictions of monetary policy moves.

In the future, we may also see the integration of AI into other aspects of monetary policy, such as forecasting inflation, GDP growth, or employment trends. AI could help central banks more effectively navigate the complexities of the global economy and respond to crises with greater agility.

Conclusion

The Bundesbank’s decision to use AI to monitor the tone of ECB statements is a game-changer for investors. By providing clearer, more objective insights into central bank sentiment, this tool will help investors make more informed decisions, manage risk better, and improve their understanding of the broader economic landscape. As the financial world continues to evolve, the role of AI in monetary policy analysis will only grow, offering new opportunities for investors who are able to adapt and leverage these technological advancements.

In a world where information is power, the ability to predict shifts in central bank policy with greater precision could provide a significant edge to those in the stock market. As always, the key for investors will be to stay ahead of the curve, using the latest tools and technologies to guide their investment decisions.

This article explores the use of AI in monetary policy analysis and how it could impact stock market investing. Would you like to dive deeper into any specific aspect of this development or discuss its broader implications?

One thought on “AI in Central Banking: How the Bundesbank’s Use of AI to Track Policy Tone Impacts the Stock Market”

Comments are closed.