In today’s fast-moving financial markets, speed, efficiency, and accuracy are everything. Whether you’re trading currencies, commodities, or equities, the ability to send and receive information in milliseconds can make a huge difference in your trading results. This is exactly where FIX API comes into the picture. While many traders stick to popular platforms like MetaTrader or cTrader, a growing number of professional traders, institutional players, and advanced retail traders are turning to FIX API for its flexibility and low-latency performance.

But what exactly is FIX API, why is it so important, and how does it differ from standard trading platforms? This 1100-word guide explains the concept in simple language so you can understand its purpose, advantages, and limitations without any technical background.

What Is FIX API? A Simple Explanation

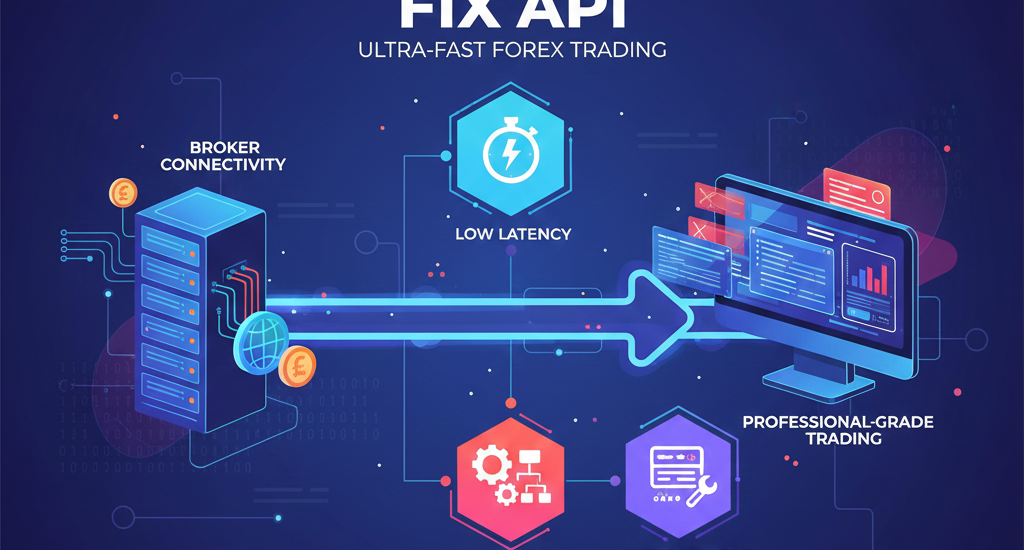

FIX API refers to the Financial Information eXchange Application Programming Interface. It is essentially a communications protocol that allows traders and financial institutions to send trading instructions, receive executions, and stream market data in real time.

Think of it as a fast, secure, standardized way for two systems—like a trader’s program and a broker’s server—to speak to each other. Instead of clicking buttons on a chart, FIX API users send trading commands through coded messages. These messages are extremely lightweight, meaning they can travel faster and more efficiently than traditional platform-based orders.

Originally, FIX API was used mainly by large institutions such as banks, hedge funds, and major brokers. But today, more advanced individual traders also use it, especially those involved in algorithmic or high-frequency trading.

How the FIX Protocol Started

The FIX protocol was created in 1992 to modernize the way equity traders communicated. Before FIX, most trade instructions were transmitted manually—over phones or through clunky systems that slowed down decision-making. The creators of FIX wanted something universal, fast, and standardized that could reduce errors and improve efficiency.

Over time, the protocol grew beyond equities. Today, it is used in forex, commodities, metals, indices, futures, and options markets across the world. It is managed by a non-profit organization in the UK called FIX Protocol Ltd. Because it is non-proprietary, no one “owns” FIX. It is free to use, can be customized, and is constantly being improved by the global financial community.

The most commonly used version today is FIX 4.4, which is widely supported by brokers and institutions.

What Makes FIX API So Popular?

There are several reasons why FIX API has become such an essential part of electronic trading. Its appeal lies in its combination of speed, stability, and flexibility.

1. Extremely Fast and Efficient

FIX messages are incredibly lightweight. They contain only the essential information required to execute or modify an order. Because of this, orders sent through FIX often reach the broker’s server faster than orders sent through traditional trading platforms.

This speed is especially important in strategies that require split-second execution, such as scalping, arbitrage, or high-frequency trading.

2. Multi-Broker Connectivity

One of the biggest advantages of FIX is that you can connect to several brokers at once. This is extremely valuable if you want to:

- Compare price feeds

- Access different liquidity pools

- Split orders across multiple environments

- Back-test strategies across diverse conditions

Standard trading platforms rarely allow this level of direct connectivity.

3. Works With Most Programming Languages

Because FIX API uses socket communication, a trader or developer can build their trading system using languages like:

- Python

- C++

- Java

- C#

- Go

- JavaScript

This flexibility opens the door for more customized trading algorithms and data-processing tools.

4. Free and Non-Proprietary

The FIX protocol is intended to remain free forever. Anyone can download the specifications and build systems around it. This openness has helped FIX become a global standard for financial communication.

Understanding FIX Engines

To use FIX API, both the broker and the client need software called a FIX engine. These engines send, receive, and interpret FIX messages. They act as the “interpreter” between your application and the broker’s trading servers.

Popular options include:

- QuickFIX — a widely used open-source FIX engine

- QuickFIX/J — Java version

- QuickFIX/N — .NET version

These engines greatly simplify the development process, allowing traders to focus more on strategy rather than building messaging systems from scratch.

Limitations of FIX API You Should Know

While FIX API offers many benefits, it also has certain limitations that beginners should understand before adopting it.

1. No Support for Certain Account Functions

FIX is built mainly for:

- Real-time market data

- Placing, modifying, and canceling orders

It does not include messages for:

- Account balance

- Equity

- Used or free margin

- Historical data

- Open or closed positions

If a trader needs this information, the broker must provide an alternative API or custom solution.

2. No Historical Data

FIX API only streams live market data. It cannot retrieve past price information. Traders who rely on historical back-testing must gather data from other sources.

3. Limited Transaction Types

The FIX protocol uses a fixed set of message types. Although customizable, it doesn’t offer complete flexibility for extra non-standard operations. This can affect users who need advanced or highly specialized functions.

4. Requires Technical Skills

Unlike MetaTrader, where you click buttons, FIX API requires:

- Programming knowledge

- Understanding of networking

- Familiarity with FIX message formats

- Ability to build or integrate a FIX engine

For non-technical traders, this can be a barrier.

Is FIX API Free for Retail Traders? The Reality

While the protocol itself is free, gaining FIX access from brokers often isn’t. Many brokers charge extra or require:

- High minimum deposits

- High monthly trading volumes

- A separate approval process

- Monthly fees or administrative charges

This is because maintaining FIX servers and support teams requires additional resources. Retail traders also need to build their own trading interface or hire developers, adding to the cost.

Why Advanced Traders Prefer FIX API

Despite the challenges, FIX API remains the preferred choice for traders who want maximum control over their trading environment. It offers:

- Faster execution

- Direct connection to liquidity providers

- Better customization options

- Lower latency than traditional platforms

For algorithmic traders, FIX API is the ultimate tool that allows trading strategies to operate without the limitations of platform-based execution.

Final Thoughts

FIX API is a powerful and professional-grade solution for traders who want direct access to markets without platform limitations. It provides unmatched speed, stability, and flexibility, making it ideal for algorithmic trading, high-frequency strategies, and multi-broker environments.

However, it also requires technical skills, additional setup, and often a higher financial commitment. For traders willing to put in the effort, FIX API offers a major edge in today’s competitive markets.

One thought on “A Complete, Easy-to-Understand Guide to FIX API in Forex Trading”

Comments are closed.