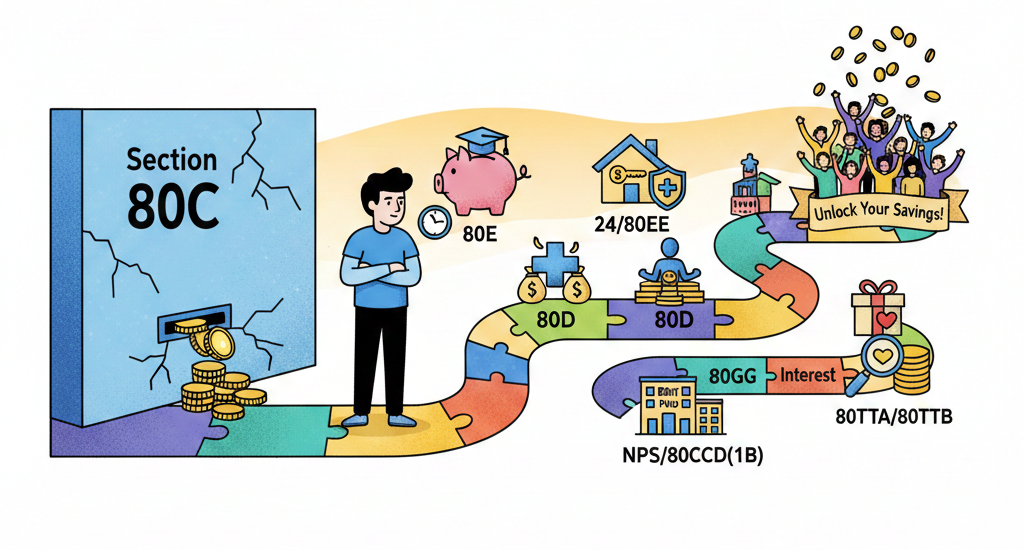

In the complex world of Indian personal finance, the mere mention of “March 31st” is enough to trigger a minor panic. For most salaried employees, tax planning usually begins and ends with Section 80C. We scramble to dump money into ELSS funds, Public Provident Funds (PPF), or life insurance premiums, all to hit that magic ₹1.5 lakh ceiling. But here is the reality: for many middle-to-high-income earners, that ₹1.5 lakh limit is exhausted almost instantly by mandatory Employee Provident Fund (EPF) contributions and children’s school fees.

If you stop there, you are essentially leaving money on the table. The Indian Income Tax Act is often criticized for its complexity, but within that complexity lies a treasure trove of legitimate “tax escapes” that go far beyond the exhausted boundaries of 80C.

To truly optimize your take-home pay, you need to look at the “hidden” sections—the ones that reward you for taking care of your health, investing in your retirement, and even paying for your home. Based on the insights from the recent Livemint analysis, let’s dive deep into the 10 most effective ways to slash your taxable income using the “forgotten” sections of the tax code.

1. The NPS Power Move: Section 80CCD(1B)

While the National Pension System (NPS) is often grouped with 80C, it has a secret weapon. Under Section 80CCD(1B), the government allows an exclusive additional deduction of ₹50,000.

If you are in the 30% tax bracket, utilizing this section alone can save you an extra ₹15,000 in taxes every year. Beyond the tax savings, the NPS is one of the most cost-effective retirement tools available, allowing you exposure to equity markets with professional management at a fraction of the cost of a mutual fund. It’s a win-win: you build a sunset fund while keeping the taxman at bay today.

2. The Health Shield: Section 80D

Many people view health insurance as an expense; savvy taxpayers view it as a strategic deduction. Section 80D is remarkably generous.

However, the real benefit kicks in when you pay for your parents. If your parents are senior citizens (over 60), you can claim an additional ₹50,000. Combined, a taxpayer could potentially deduct ₹75,000 from their taxable income. Even if you don’t have insurance for senior citizen parents, you can claim deductions for their medical expenses under this section. Furthermore, don’t forget the ₹5,000 sub-limit for “preventive health check-ups”—it’s a small but easy way to round off your deductions.

3. Investing in the Mind: Section 80E

Student debt is a global crisis, but the Indian tax code offers a significant silver lining. Under Section 80E, the entire interest component of an education loan is deductible. There is no upper monetary limit. Whether you are paying off your own MBA loan or a loan for your child’s engineering degree, every rupee of interest paid can be subtracted from your taxable income.

4. The Homeowner’s Advantage: Section 24(b)

While Section 80C covers the principal repayment of a home loan, Section 24(b) focuses on the interest. For a self-occupied property, you can deduct up to ₹2 lakh in interest payments annually.

In the early years of a home loan, the interest component is usually much higher than the principal, making this section the “heavy lifter” of tax planning. If you own a second home that is rented out, the news is even better: there is currently no maximum ceiling on the interest deduction for let-out properties, though losses under the head “Income from House Property” can only be offset against other income up to ₹2 lakh per year.

5. First-Time Buyers: Section 80EE

If you are a first-time homebuyer, the government wants to reward your milestone. Section 80EE allows an additional deduction of ₹50,000 on home loan interest. This is independent of the ₹2 lakh limit under Section 24. To qualify, the loan must have been sanctioned within specific windows (usually related to the property value and loan amount), but for those who qualify, it brings the total interest deduction potential to a whopping ₹2.5 lakh.

6. The “No HRA” Relief: Section 80GG

A common misconception is that you can only save on rent if your employer provides House Rent Allowance (HRA). What if you are a freelancer, a consultant, or work for a small startup that doesn’t offer HRA?

Section 80GG is your safety net. It allows you to claim a deduction for rent paid even if you don’t receive HRA. While the limit is capped at ₹5,000 per month (₹60,000 per year), it provides essential relief to those in the informal or gig economy who are otherwise overlooked by standard corporate tax structures.

7. Savings Account Perks: Section 80TTA & 80TTB

Most of us keep a “parking fund” in a savings account. The interest earned on these balances is taxable, but Section 80TTA provides a buffer. You can earn up to ₹10,000 in savings interest tax-free.

For senior citizens, the benefit is even more robust under Section 80TTB, which raises the limit to ₹50,000 and includes interest from Fixed Deposits (FDs) and Recurring Deposits (RDs). For retirees living on interest income, this is a vital provision that protects their purchasing power.

8. Supporting Dependents with Disabilities: Section 80DD

Tax law isn’t just about math; it’s about social equity. Section 80DD allows taxpayers to claim a deduction for the medical treatment, training, or rehabilitation of a disabled dependent.

The beauty of this section is that it is a flat deduction. You don’t necessarily need to show every single medical receipt. If the dependent has a disability of 40% or more, you get a flat deduction of ₹75,000. If the disability is severe (80% or more), the deduction jumps to ₹1,25,000. It is a compassionate provision designed to lower the financial burden on families providing specialized care.

9. Treating Specified Diseases: Section 80DDB

The cost of treating critical illnesses like cancer, chronic renal failure, or certain neurological diseases can be ruinous. Section 80DDB provides a deduction for expenses incurred for the treatment of such specified ailments for yourself or your dependents.

The limit is ₹40,000 for individuals, but for senior citizens, it increases to ₹1 lakh. While no one wants to find themselves in a position to need this deduction, it serves as a critical financial cushion during a family’s darkest hours.

10. Donations and Charity: Section 80G

Finally, doing good can also be good for your taxes. Contributions to certain approved charitable funds or institutions are eligible for deductions under Section 80G. Depending on the institution, you can claim either 50% or 100% of the donated amount. However, be cautious: to claim this, you must ensure the charity has a valid 80G registration, and donations above ₹2,000 must be made via digital modes or cheques (not cash) to qualify.

The Strategy: How to Approach Your Taxes

Tax planning should not be a “hide and seek” game played with the authorities. Instead, it should be a structured review of your life’s expenditures.

The mistake most people make is looking for “investments” to save tax. In reality, the most efficient tax planning often comes from expenditures you are already making. Are you paying for your parents’ medicines? (Section 80D). Are you paying rent? (Section 80GG). Are you paying off a degree? (Section 80E).

By shifting your focus away from the crowded 80C corridor and exploring these ten avenues, you can build a tax strategy that is both more effective and more reflective of your actual financial life. Remember, every rupee saved in tax is a rupee earned for your future. Don’t let the simplicity of 80C blind you to the thousands of rupees waiting to be saved elsewhere in the rulebook.