Trading runs 24 hours a day, attracts millions of traders worldwide, and offers the alluring possibility of substantial profits. But while the idea of making money by predicting currency movements sounds straightforward, the reality is far more complex. The U.S. Commodity Futures Trading Commission (CFTC) regularly warns individuals about the significant risks tied to forex trading, especially for retail traders.

This article explains those key risks in a clear, human-friendly manner, helping traders understand how to protect themselves, avoid scams, and make better-informed decisions. By the end, you’ll have a well-rounded understanding of what truly goes on in the forex market and what precautions you should take before risking your money.

Forex Trading Is Not Suitable for Everyone

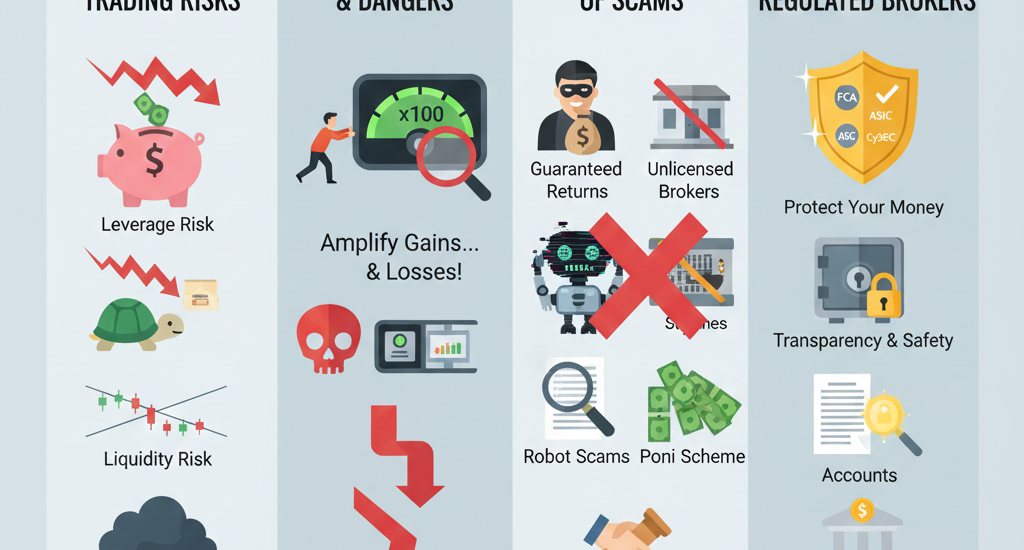

One of the core messages from the CFTC is that forex trading is highly speculative and not appropriate for all investors. Unlike traditional investing—where you might buy stocks, bonds, or mutual funds—forex trading involves predicting short-term movements in currency pairs. Even small price changes can lead to major gains or losses because forex trading often uses leverage.

New traders often underestimate how volatile currency markets can be. While leverage can magnify profits, it can also amplify losses just as quickly. Many retail traders end up losing more money than they initially invest, especially when using high leverage without proper risk management.

It’s important to assess your financial condition, risk tolerance, and trading knowledge before diving into forex. Simply put: If you cannot afford to lose the money you plan to trade, you should not be trading forex in the first place.

Beware of Fraudulent Forex Firms and Individuals

The CFTC stresses that forex-related fraud has grown significantly over the years. Scammers often target inexperienced traders with promises of guaranteed profits, risk-free trading, or proprietary trading systems that allegedly produce high returns.

Common red flags include:

- Firms promising unusually high returns with no losses

- “Traders” claiming they can double or triple money quickly

- Pressure to deposit funds immediately

- Unregulated brokers operating from offshore locations

- No transparency regarding trading platforms or fees

- “Managed accounts” where you hand over money to someone who trades for you

Fraudsters frequently use social media ads, WhatsApp groups, Telegram channels, and flashy websites to lure victims. The CFTC emphasizes verifying whether a broker is registered before depositing funds. In the United States, forex dealers must register with the CFTC and be members of the National Futures Association (NFA).

A quick search in the NFA BASIC database can help confirm whether the firm or individual is legitimate. If the broker is not registered, that’s a major warning sign.

Understand How Leverage Works

Leverage is one of the biggest attractions—and biggest dangers—of forex trading. For example, with 50:1 leverage, a $1,000 deposit allows you to control a $50,000 position in the market.

But this magnification cuts both ways.

A currency pair moving just 1% against you can wipe out your entire balance under high leverage conditions. Many traders lose money not because the market is unfair, but because they underestimate how fast losses can accumulate.

Professional traders usually use much lower leverage and strict risk management rules. Retail traders, however, often get seduced by the possibility of turning small amounts of money into large profits quickly—only to blow up their accounts.

Before trading, it’s crucial to:

- Use low leverage

- Set stop-loss levels

- Never risk more than you can afford to lose

- Avoid emotional or impulsive trading

Leverage can be a useful tool, but misused leverage is one of the main reasons retail traders lose money.

Forex Trading Has Significant Costs and Complex Terms

Another major point in the CFTC advisory is that forex trading comes with several costs and conditions traders often overlook.

These include:

- Spreads: The difference between the buying (ask) and selling (bid) price.

- Commissions: Some brokers charge fees per trade.

- Overnight financing fees: Holding positions overnight may incur extra charges.

- Margin calls: If your balance falls below the required margin, the broker may close your positions automatically.

Many traders jump into forex without understanding these details, only to find their profits reduced or losses increased by fees they didn’t account for.

Moreover, forex trading involves complex terminology—like pips, lots, margin, rollover rates, and liquidity—that traders must grasp to navigate the market safely. Failing to understand these may cause confusion and poor decision-making.

Regulation Matters—Choose Only Registered Forex Dealers

The CFTC emphasizes that choosing a regulated broker is one of the most important decisions a trader can make. Regulation ensures that the firm follows specific financial standards, maintains separate accounts for client funds, and adheres to ethical practices.

In the U.S., legitimate forex dealers must register with:

- CFTC (Commodity Futures Trading Commission)

- NFA (National Futures Association)

These organizations monitor brokers, enforce rules, and provide channels for dispute resolution in case something goes wrong.

Unregulated or offshore brokers may offer high leverage, bonuses, or attractive trading conditions, but they come with significant risk. If such a broker shuts down suddenly or refuses to process withdrawals, recovering your money becomes nearly impossible.

Always verify a broker’s registration status before trading. It’s your first line of defense against fraud.

Know the Warning Signs and Protect Yourself

The CFTC urges traders to stay alert and protect themselves from unnecessary risks and scams. Some of the most important protective measures include:

- Checking broker registration on NFA BASIC

- Reading all terms and agreements carefully

- Understanding the broker’s fee structure

- Testing the platform through a demo account

- Avoiding “too good to be true” promises

- Being cautious with individuals offering trading signals or account management

- Never giving remote access to your devices

- Keeping personal and banking information safe

Forex trading requires education, discipline, and skepticism. Being prepared and vigilant goes a long way in preventing losses.

Final Thoughts

Forex trading can be an exciting way to participate in global financial markets, but it is also full of risks. The CFTC’s advisory reminds traders that success requires deep understanding, careful research, and realistic expectations.

Whether you’re just exploring forex or already trading, the most important principles remain the same: stay informed, remain cautious, use regulated brokers, and never risk more money than you can afford to lose. When approached responsibly, forex trading can be an educational and potentially rewarding experience—but only when done with proper knowledge and risk management.

One thought on “The Essential Guide to Understanding Forex Trading Risks: What Every Trader Must Know”

Comments are closed.