The global financial landscape is undergoing a profound and irreversible shift, driven not by volatile cryptocurrencies or ephemeral memes, but by the quiet, steady rise of the digital dollar. At the epicenter of this structural change stands Rune Christensen, the founder and CEO of Sky (formerly the pioneering decentralized autonomous organization, MakerDAO), who observes an unprecedented phenomenon: the institutional world’s growing “obsession” with stablecoins. After years spent building and refining the complex decentralized architecture underpinning his protocol, Christensen asserts that the era of architectural overhaul is over, and Sky’s stablecoin, USDS, is now entering its critical scaling phase, fueled directly by a burgeoning demand for transparent, yield-bearing digital assets.

The Institutional Awakening: Stablecoins as the New Financial Obsession

Christensen’s central observation is that large, established financial institutions—commonly referred to as TradFi—are no longer viewing stablecoins as a fringe component of the crypto market. Instead, they are increasingly recognizing them as the foundational infrastructure for a future financial system.

“One thing I’m very happy about is that stablecoins have become almost an obsession for institutions,” Christensen noted. This fixation stems from the undeniable, inherent advantages stablecoins offer: they combine the stability of fiat currency with the efficiency and speed of blockchain technology. They facilitate 24/7, borderless, near-instant settlement, and offer unprecedented programmability—benefits that conventional banking systems simply cannot match. Institutions realize that stablecoins are poised to fundamentally reshape mechanisms like cross-border payments, corporate treasury management, and high-frequency trading.

However, this institutional enthusiasm is tempered by a persistent knowledge gap. While they understand the benefits of the end product, many institutional players remain “quite confused and don’t fully grasp the mechanics,” particularly concerning decentralized governance and novel risk structures. This dichotomy—intense demand coexisting with conceptual confusion—creates a unique opportunity for protocols like Sky, which are mature enough to handle institutional scale but require clarity to onboard non-crypto-native users. The challenge, therefore, is not merely to capture capital inflows but to build the capacity and the communicative interfaces necessary to safely integrate this colossal pool of institutional wealth.

The USDS Scaling Era: From Architectural Overhaul to Aggressive Growth

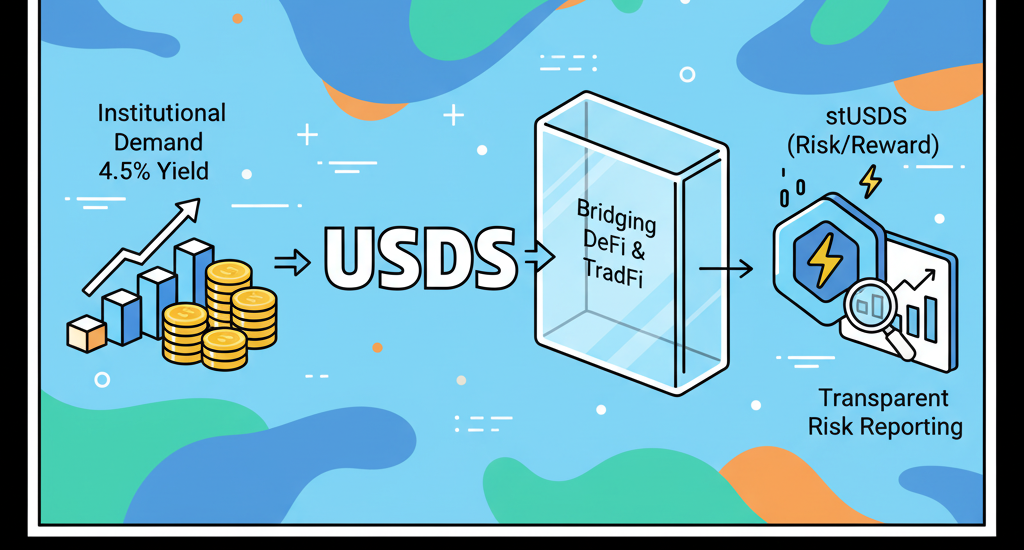

The current pivot to aggressive scaling for USDS marks the culmination of a multi-year, often arduous, effort to upgrade and future-proof the Sky protocol. Sky, which evolved from the original MakerDAO framework, powers USDS, which the company proudly describes as the largest decentralized yield-bearing stablecoin on the market.

Christensen explains that the protocol had reached a turning point following a comprehensive, multi-year upgrade to its decentralized risk framework. The original MakerDAO system scaled rapidly in its nascent years but eventually outgrew its initial design constraints. This necessitated a painful, yet crucial, process of “reinventing processes and infrastructure from scratch for a decentralized paradigm.”

With that deep architectural migration now complete, the focus for the protocol has unequivocally shifted. The goal for Sky over the coming years is twofold: to absorb more and more institutional capital and to do so without creating systemic risk or allowing processes to fall apart. The plan is to aggressively grow the USDS supply, deepen its integrations across the broader fintech landscape, and enable wallets and businesses globally to offer the inherent USDS savings rate directly to their end-users. This transition from a project primarily focused on resilience and architecture to one focused on growth and penetration signals a significant maturation of the decentralized finance (DeFi) space.

The Irresistible Allure of Decentralized Yield

A critical factor driving the institutional appetite for USDS is its defining feature: it is a yield-bearing stablecoin. It currently offers a competitive 4.5% savings rate, making it an attractive destination for professional allocators seeking returns. In a traditional financial environment where low-risk, dollar-denominated yield often struggles to keep pace with inflation, the on-chain return provided by USDS stands out.

Christensen emphasizes that this yield makes the protocol a highly desirable asset for funds, crypto-native institutions, and fintech platforms looking for low-risk, transparent, and digitally native dollar exposure. As the stablecoin market as a whole grows and more money flows into the digital dollar ecosystem, a portion of that capital naturally gravitates toward robust, decentralized options that can offer competitive, verifiable returns. Sky aims to be the premier destination for that capital by offering not just a stable store of value, but an integrated, automated savings mechanism.

Navigating Regulation with Radical Transparency

One of the most complex hurdles for decentralized systems like Sky is bridging the gap between their architecture and existing regulatory frameworks. Christensen points out that current global regulation is still firmly anchored to centralized financial structures, which are built around single points of failure—centralized entities, CEOs, or treasuries—that regulators can easily identify and control.

Sky’s decentralized architecture does not map neatly onto these traditional models. By design, it has no central authority, no single approval body, and no single point of control that can be easily regulated under current mandates. This lack of fit has required Sky to innovate in the realm of risk reporting and public data.

The solution, according to Christensen, lies in radical transparency. Sky has invested heavily in developing sophisticated data-exposure and risk-reporting interfaces, designed to mimic and even surpass the utility of traditional financial dashboards. This initiative aims to make the protocol’s operational health, collateral composition, and risk metrics easily consumable by TradFi institutions, risk officers, and regulators. The reliance shifts from trusting a central party to verifying the system’s explicit data. This open verification pathway is intended to provide the confidence required by institutions, while simultaneously helping to reduce the reputational drag that the decentralized ecosystem has suffered from in earlier years due to association with “scams or badly run centralised entities.” Sky’s investment in clarity and robust data is its primary regulatory strategy.

The Future of Risk: Introducing stUSDS and Tokenization

To cater to the growing sophistication of its institutional user base, Sky recently unveiled stUSDS, an instrument that introduces a new dimension of risk management and return. Christensen describes stUSDS as an “advanced, risk-aware instrument” explicitly designed for “expert users, institutions, and smart money who know what they’re doing.”

The stUSDS token provides a higher yield in exchange for taking on higher, clearly defined risk. It functions by providing funding for Sky stakers, who can borrow against their staked Sky positions. The increased yield compensates stUSDS holders for bearing the credit risk inherent in this mechanism.

This release is significant because it is intended to be the first in a broader, structured family of risk-tiered tokens. This framework is inspired by traditional finance concepts, specifically drawing on ideas from the Basel III regulatory accords, designed to efficiently structure collateral risk across different tiers. The goal is to improve capital efficiency within the protocol while strictly maintaining the protection and stability of the core USDS stablecoin holders.

The Inevitability of Transparent, Structured Finance

Christensen believes that this new model of risk tokenization is where the ultimate convergence between decentralized finance and traditional institutional markets will occur. He argues that the on-chain version of risk-tranching offers inherent advantages over its opaque TradFi counterpart.

“In TradFi, it’s very opaque, you don’t really know the risk, you just trust the regulators,” he states. Furthermore, smaller funds or institutions are often shut out of the best opportunities. By contrast, the Sky model makes risks explicit and universally accessible. The risks are clearly defined, coded into the smart contracts, and presented via the dedicated verification pathways in a way that is understandable even to less crypto-native participants.

Christensen’s ultimate vision is one where stablecoins are an inevitable, universally adopted standard, and where the structured, transparent, and real-time on-chain risk management frameworks become the standard for all complex financial instruments. This level of clarity, accessibility, and systemic resilience, he concludes, simply would not be possible without the foundational technology of stablecoins, ushering in the true future of transparent global finance.

One thought on “The Obsession and the On-Ramp: How Institutional Demand Is Fueling Stablecoin Scaling and Financial Transparency”

Comments are closed.