Japan’s Prime Minister Sanae Takaichi has underscored the importance of maintaining a close working relationship between her government and the Bank of Japan (BOJ) to achieve the nation’s long-term economic growth and stability objectives. Her recent statements come at a time when Japan faces a delicate balance between stimulating economic activity and managing inflation expectations, all while navigating global headwinds.

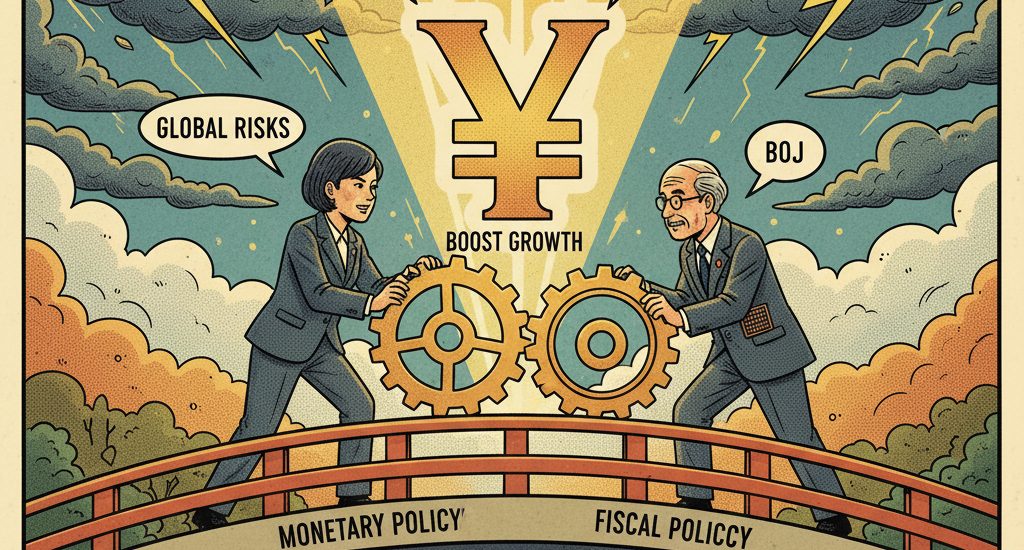

Speaking after a fiscal and economic policy council meeting, Takaichi made it clear that monetary and fiscal policies must move in tandem rather than operate in isolation. The Prime Minister’s comments signaled her administration’s commitment to ensuring that Japan’s economic recovery remains on track, particularly as external pressures such as slowing global trade and volatile currency markets continue to weigh on sentiment.

A Unified Approach to Economic Management

Takaichi’s remarks reinforced the idea that effective coordination between fiscal authorities and the central bank is crucial in the current environment. She emphasized that the BOJ’s monetary policy should complement the government’s economic strategy, which involves targeted fiscal stimulus, structural reforms, and support for industries hit by sluggish demand.

Her statement, “We will continue to work closely with the Bank of Japan to achieve stable and sustainable economic growth,” reflects a pragmatic approach. Rather than pushing for abrupt policy shifts, the government aims to create synergy between policy levers, ensuring that both monetary easing and fiscal spending pull in the same direction.

This kind of coordination is not new in Japan’s policy landscape. For decades, the BOJ and the government have collaborated to combat deflationary pressures. However, what makes Takaichi’s stance notable is her insistence on deeper, institutionalized cooperation. She proposed that the BOJ Governor provide regular updates at council meetings, ensuring transparency and accountability in how monetary policy decisions align with the government’s fiscal objectives.

New Stimulus Measures on the Horizon

Takaichi also revealed that the government is preparing a new fiscal stimulus package, expected to exceed the scale of last year’s measures. While specific details have yet to be announced, sources suggest that the plan will focus on supporting domestic demand, boosting investment in innovation and green technology, and providing relief to households affected by rising living costs.

Japan’s economy has shown moderate growth in recent quarters, but challenges persist. Consumer spending remains uneven, and the global slowdown has affected export performance. The new package, according to Takaichi, will target these pain points, aiming to keep the recovery momentum alive.

The Prime Minister’s focus on proactive fiscal policy also highlights her intent to avoid over-reliance on the BOJ’s ultra-loose monetary stance. “We are considering comprehensive measures to sustain growth and enhance the economy’s resilience,” she noted, implying that fiscal spending will play a more prominent role in the next phase of Japan’s economic management.

Market Reactions and Yen Movement

Financial markets responded immediately to Takaichi’s comments. The Japanese Yen (JPY) weakened slightly against the US Dollar, with the USD/JPY pair climbing toward the 155.00 level. Traders interpreted her statements as a signal that the government would tolerate a continued period of accommodative monetary conditions.

The weaker yen reflects market expectations that the BOJ will maintain its current stance for longer, prioritizing economic support over aggressive inflation control. While a softer yen benefits exporters by making Japanese goods more competitive abroad, it also raises import costs—particularly for energy—posing a dilemma for policymakers.

Analysts suggest that Takaichi’s emphasis on coordination may limit the BOJ’s room for maneuver in the short term. If the central bank were to tighten policy too quickly, it could undermine the government’s fiscal efforts to stimulate growth. Conversely, continued monetary accommodation might fuel concerns about long-term financial stability or imported inflation.

Balancing Growth with Inflation Control

Japan’s inflation rate has stabilized around the BOJ’s 2% target after years of deflationary tendencies. However, the composition of price pressures remains a concern. Much of the recent inflation has been driven by import costs rather than robust domestic demand. For this reason, policymakers are cautious about declaring victory too soon.

Takaichi’s call for closer alignment between the BOJ and the government reflects this complexity. She believes that achieving sustainable growth requires both stable prices and rising wages, supported by strong domestic consumption. Her message implies that the BOJ should continue supporting the recovery while remaining flexible enough to adjust policy if inflationary pressures persist.

The government’s strategy also involves encouraging corporate investment and innovation. The administration is exploring incentives for industries adopting digital transformation and renewable energy technologies—both seen as essential drivers of long-term productivity.

The Political and Economic Context

Takaichi’s remarks also carry political significance. As Japan’s first female Prime Minister in recent history, she faces pressure to demonstrate economic competence and policy coherence. By emphasizing coordination with the BOJ, she aims to project stability and reinforce investor confidence in her administration’s economic vision.

Her comments come amid heightened scrutiny of Japan’s fiscal discipline. The country’s public debt remains one of the highest among developed economies, exceeding 250% of GDP. Critics argue that large stimulus packages risk worsening fiscal imbalances. However, Takaichi and her advisors contend that sustained growth will ultimately help stabilize debt ratios by boosting tax revenues.

Furthermore, geopolitical uncertainty in East Asia and global trade realignments are compelling Japan to strengthen its domestic economic base. Ensuring that fiscal and monetary policies work in harmony is seen as a safeguard against external shocks.

What Lies Ahead for Japan’s Economy

Looking ahead, Takaichi’s policy direction suggests a continuation of Japan’s long-standing strategy of gradual normalization rather than abrupt tightening. The BOJ, under its current leadership, has already taken modest steps toward adjusting its yield curve control framework, allowing slightly higher long-term bond yields. But the central bank remains cautious, aware that tightening too soon could stifle growth.

The government, for its part, will likely focus on policies that bolster real income growth, promote labor participation, and attract private investment. The fiscal package under preparation is expected to include subsidies for small businesses, infrastructure upgrades, and renewable energy initiatives.

Economists note that if coordination between the government and BOJ deepens effectively, Japan could see more balanced growth driven by both public and private sector demand. However, the success of this approach will depend on maintaining credibility—markets must trust that fiscal expansion will not spiral into excessive borrowing, and that monetary support will be adjusted when conditions warrant.

Conclusion

Prime Minister Sanae Takaichi’s emphasis on coordination with the Bank of Japan reflects a pragmatic approach to economic management. Rather than pursuing short-term fixes, her administration seeks a synchronized strategy where fiscal expansion and monetary accommodation complement each other to sustain growth.

Her comments underscore Japan’s determination to steer its economy toward stability amid global uncertainty. While market participants expect accommodative policies to persist, the government’s proactive stance and emphasis on structured communication with the BOJ could enhance policy effectiveness.

In the near term, the focus will remain on how Japan balances the need for growth with the imperative of fiscal prudence. If Takaichi’s government and the BOJ succeed in aligning their objectives, Japan could chart a steady course toward sustainable expansion and economic resilience.

2 thoughts on “Japan’s PM Takaichi Emphasizes Close Coordination with BOJ to Achieve Growth Goals”

Comments are closed.