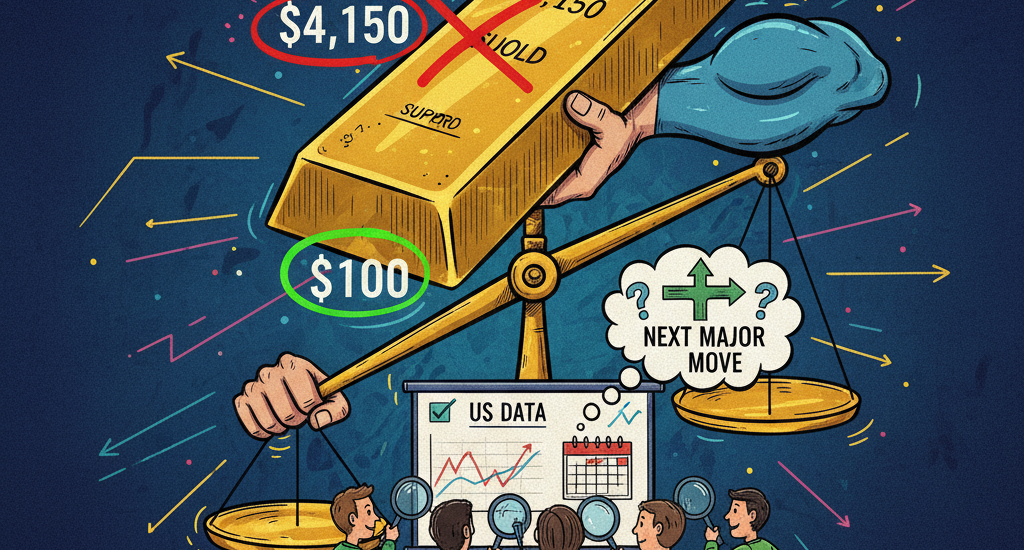

Gold prices have paused their recent rebound, struggling to gain momentum beyond the key $4,150 resistance level. The metal’s earlier recovery attempt has lost steam as investors turned cautious amid renewed strength in the US Dollar and shifting market sentiment ahead of upcoming US economic data.

After several sessions of volatility, gold (XAU/USD) remains trapped in a tight trading range. The market’s inability to sustain gains above the $4,150 threshold reflects a mix of technical hesitation and fundamental cross-currents. Traders are now closely watching both macroeconomic signals and global risk trends to determine the metal’s next directional move.

Gold Struggles to Extend Its Rebound

Following last week’s attempt to recover from near-term lows, gold initially climbed toward $4,150 but faced heavy selling pressure around that region. The price has since retreated slightly, indicating that bulls lack the conviction to push higher for now.

The $4,150 level has emerged as a strong resistance zone in recent sessions, capping multiple recovery attempts. Each time prices approach this level, profit-taking by traders and renewed demand for the Dollar tend to halt momentum. The consolidation suggests that investors are waiting for clearer cues—perhaps from upcoming inflation data or Federal Reserve commentary—before committing to new long positions.

Despite the short-term pause, gold’s broader uptrend remains largely intact. The market continues to be supported by geopolitical uncertainty, central-bank buying, and long-term concerns about the durability of global growth. However, the near-term technical picture suggests caution as gold finds it difficult to sustain upward momentum amid shifting macro headwinds.

Dollar Strength Weighs on Gold

A key factor behind gold’s struggle to break higher is the recent rebound in the US Dollar Index (DXY). The greenback has strengthened as investors once again factor in the possibility that US interest rates could remain higher for longer.

A firmer dollar typically pressures gold because the precious metal is priced in USD, making it more expensive for holders of other currencies. As a result, international demand tends to cool when the Dollar gains. This inverse relationship between the two assets remains one of the most significant short-term drivers of gold’s price.

Additionally, yields on US Treasury bonds have edged higher this week, further dampening the appeal of non-yielding assets like gold. Traders appear to be adjusting portfolios in anticipation of upcoming US inflation figures and retail sales data, which could offer clues about the Federal Reserve’s next policy direction.

If these economic indicators surprise to the upside, the Dollar could extend its rally, adding more pressure to gold prices in the near term.

Support Remains Near $4,100

On the downside, gold has found support near $4,100, a level that has held firm several times in recent trading sessions. Buyers have stepped in at this zone whenever the metal dips, suggesting that sentiment remains cautiously optimistic despite short-term weakness.

This support level aligns with gold’s 20-day exponential moving average, which often acts as a pivot for intraday traders. A sustained hold above $4,100 would keep the broader technical outlook constructive, while a decisive break below could trigger a deeper retracement toward the psychological level of $4,000.

For now, the price structure indicates consolidation rather than reversal. The market seems to be in a waiting phase, digesting earlier gains and recalibrating to shifting macro conditions.

Technical Indicators Show Mixed Momentum

Gold’s technical picture currently presents a mix of signals. The MACD indicator on the 4-hour chart has recently flashed a bearish crossover, implying that momentum may tilt slightly toward the downside in the short term. This signal reflects fading buying pressure after the recent attempt to break above $4,150.

However, other indicators such as the Relative Strength Index (RSI) remain neutral, suggesting that gold is not yet in overbought or oversold territory. This reinforces the view that the current movement represents consolidation rather than a full-fledged reversal.

From a broader technical perspective, the metal’s longer-term trend remains bullish, supported by higher lows on the daily chart and strong institutional demand. Yet, traders should watch for confirmation signals before anticipating a major breakout or breakdown.

Breakout Above $4,150 Could Revive Bullish Momentum

Should gold manage to clear and hold above the $4,150 resistance on a daily closing basis, the market could witness renewed buying momentum. Such a move would likely attract technical traders looking for continuation toward the next target zone near $4,220, followed by the previous swing high around $4,380.

A breakout could be driven by weaker-than-expected US data, dovish comments from Federal Reserve officials, or geopolitical uncertainty that boosts safe-haven demand. Gold has a long history of responding positively to rising global risks, and any sign of instability—whether economic or political—tends to provide strong tailwinds for the metal.

If this bullish scenario unfolds, traders may view the recent consolidation below $4,150 as a healthy pause before the next leg higher.

Failure to Break Resistance May Invite Renewed Selling

Conversely, if gold continues to fail at the $4,150 barrier, it could trigger another round of profit-taking and invite fresh selling pressure. In such a case, the price may slip back toward $4,090, with further downside potential to $4,050 and possibly even below $4,000 if bearish momentum strengthens.

A break below $4,100 support would be significant, as it could shift short-term sentiment and encourage technical traders to adopt a more defensive stance. This would also raise the risk of a broader pullback, especially if the Dollar remains strong or US yields continue to rise.

Still, analysts emphasize that any such decline could prove temporary, given the ongoing global appetite for gold as a strategic hedge. Central banks, particularly in emerging markets, have continued to accumulate gold reserves this year, providing a solid underlying demand base that limits deep corrections.

Macro Backdrop and Market Sentiment

Beyond technical factors, gold’s performance remains tied to broader macroeconomic and geopolitical developments. The metal often thrives in uncertain conditions, and current global dynamics provide a complex backdrop.

Traders are monitoring several key themes:

- The trajectory of US inflation and its implications for Federal Reserve policy.

- The stability of global bond markets and yields.

- Geopolitical tensions that could increase safe-haven demand.

- Fluctuations in global equity markets and investor risk appetite.

If global risk sentiment deteriorates, investors may return to gold as a defensive asset. On the other hand, if optimism over economic growth and corporate earnings strengthens, risk-on sentiment could reduce demand for the metal in the short run.

What to Watch Ahead

Looking ahead, the upcoming US consumer price index (CPI) data and retail sales reports could provide critical direction for gold. Softer-than-expected figures might ease expectations for further Fed tightening, weakening the Dollar and pushing gold higher. Conversely, stronger numbers could reinforce the case for prolonged high rates, dampening gold’s appeal.

Traders are also paying close attention to central-bank commentary in both the US and Europe. Any signal of policy divergence or increased concern about global growth could shift demand patterns across currencies and commodities alike.

For now, analysts suggest that gold’s path of least resistance remains sideways, with support at $4,100 and resistance at $4,150 forming the immediate trading corridor.

Conclusion

Gold’s latest price action reflects a classic tug-of-war between bullish fundamentals and short-term headwinds. The metal’s failure to break above $4,150 shows that traders remain cautious amid a stronger Dollar and mixed technical signals.

However, with inflation concerns lingering and central banks maintaining a long-term preference for gold, the broader outlook remains constructive. Whether the next breakout is higher or lower will depend largely on the tone of upcoming economic data and investor sentiment in the global market.

For now, gold traders continue to walk a fine line—balancing optimism about long-term demand with caution about near-term volatility.