A Check on the Health of U.S. Consumers: What It Means for the Stock Market

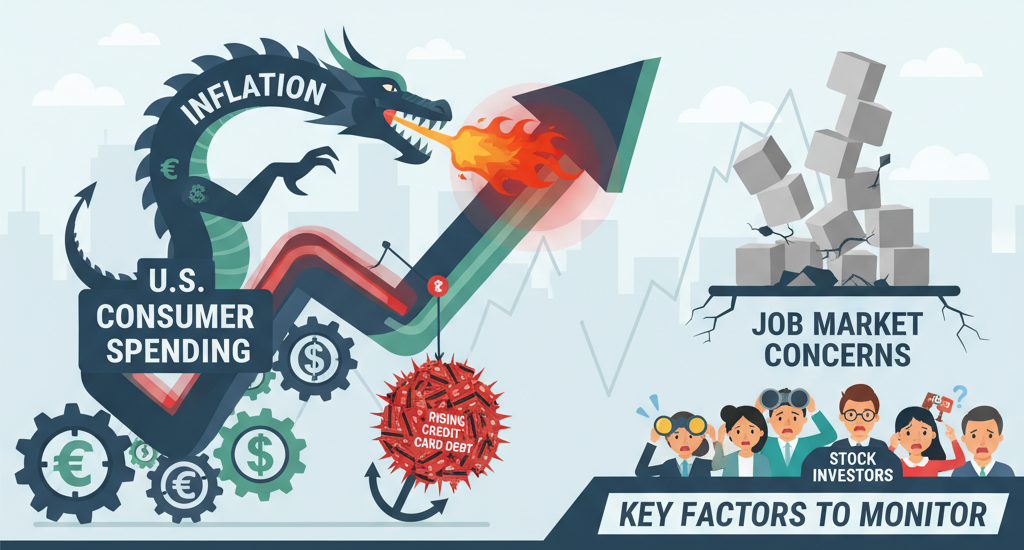

As we enter the final quarter of the year, one of the key areas investors need to keep a close eye on is the health of U.S. consumers. Consumer spending has long been the backbone of the U.S. economy, and it serves as an essential indicator for gauging economic strength. But with inflationary pressures, rising credit card debt, and fluctuating job market conditions, how are consumers holding up? And more importantly, what does this mean for the stock market in the coming months?

Resilient Consumer Spending Amid Economic Pressure

Despite the roller-coaster ride that the economy has been on over the last couple of years, one thing has remained relatively stable: consumer spending. The U.S. consumer, accounting for approximately 70% of the nation’s GDP, continues to show resilience. According to recent data, consumer spending has remained steady, particularly in sectors like retail and housing, where recovery has been more pronounced.

Retail sales, in particular, are a bright spot. While growth has slowed from pandemic-era highs, consumer confidence is picking up, particularly in luxury goods and high-end retail. The shift towards online shopping has continued to grow, with e-commerce giants like Amazon and Walmart benefiting from the ongoing trend. The housing market has also shown signs of life, particularly in areas where home values have not been as affected by rising interest rates.

For stock market investors, this resilience in consumer spending provides some comfort. Companies in the consumer discretionary sector—such as Amazon, Nike, and Home Depot—are often seen as a bellwether for overall economic health. As consumer spending holds steady, these companies are likely to continue seeing steady earnings growth, which bodes well for their stock prices.

However, it’s important to note that while consumer spending remains strong, it is not impervious to inflation. Rising costs of goods and services—especially in sectors like food, energy, and healthcare—continue to weigh heavily on the average consumer’s wallet. As inflation cools off in some areas, it still represents a significant headwind for households, particularly those in lower-income brackets. For investors, this means that while overall consumer spending may be stable, the composition of that spending is shifting.

Inflation: The Elephant in the Room

Inflation is one of the most significant factors influencing consumer behavior right now. Even as consumer spending shows resilience, the rising cost of living is making things difficult for many households. The Consumer Price Index (CPI) has slowed from its peak levels, but inflation is still above the Federal Reserve’s target of 2%. The cost of essentials, particularly food and energy, has remained high, creating a situation where consumers feel the pinch.

One area where inflation has had a noticeable impact is in credit card spending. Consumers are increasingly relying on credit to maintain their lifestyles, particularly in high-cost regions like California and New York. The Federal Reserve’s interest rate hikes, aimed at curbing inflation, have led to higher borrowing costs, and credit card interest rates are hitting multi-year highs.

For stock investors, this is a potential red flag. The rise in consumer debt levels, particularly revolving credit, could lead to slower consumption in the future if consumers find themselves buried under debt. Companies that rely heavily on consumer debt—like credit card providers or certain retail businesses—may see slower growth as a result.

The Labor Market: A Double-Edged Sword

The labor market has been another bright spot in the U.S. economy. Job growth has continued at a solid pace, and wages have been rising, especially for lower-income workers. These factors have supported consumer confidence, even amid higher costs and rising debt. Many consumers feel they can weather inflationary pressures as long as they remain employed and their wages continue to rise.

However, there are cracks in the labor market that investors should keep an eye on. While unemployment remains low, there is growing concern about the long-term impact of higher interest rates on job creation. Sectors like housing, construction, and real estate have already begun to feel the effects of the Fed’s rate hikes, and other industries could follow suit if the central bank continues to tighten monetary policy.

A slowdown in job growth could trigger a pullback in consumer spending. If consumers feel less secure in their jobs, they are less likely to make large purchases or take on new credit. This, in turn, could lead to a dip in stock prices, especially for companies that depend on strong consumer sentiment to drive revenue.

Credit Card Debt: A Growing Concern

While consumer spending has held up well, one area of concern for many economists is the rising level of credit card debt. According to the Federal Reserve, credit card balances in the U.S. have risen sharply, nearing pre-pandemic levels. At the same time, credit card interest rates have climbed, leaving many consumers in a precarious financial situation.

The rise in credit card debt is significant because it suggests that many consumers are relying on borrowing to keep up with the cost of living. This is particularly true for middle-income households, which have seen wage growth outpaced by inflation. With more disposable income being allocated to paying off interest on credit cards, there is less money available for discretionary spending, which could hurt companies in the consumer goods and services sectors.

From a stock market perspective, this could be a double-edged sword. On one hand, the credit card companies themselves—Visa, Mastercard, and American Express—could benefit from higher interest rates and increased consumer borrowing. However, if the trend of rising debt continues unchecked, there could be a slowdown in overall consumer spending, which would negatively impact consumer-facing stocks.

Savings Rates: The Decline of Financial Cushion

Another key indicator to watch is the rate at which Americans are saving. Household savings rates, which spiked during the pandemic, have since declined significantly. Many consumers are now spending a larger portion of their disposable income rather than saving for the future. While this may seem like a positive sign for the economy in the short term, it could have longer-term consequences.

As savings rates decline, consumers may find themselves more vulnerable to economic shocks—whether it be a downturn in the job market, unexpected medical expenses, or a financial crisis. This could lead to a reduction in consumer confidence, which would have a ripple effect on the stock market.

Investors should keep an eye on the personal savings rate as it can offer valuable insight into how consumers are positioned financially. A further decline could signal that many consumers are living paycheck to paycheck, which could limit their ability to maintain current levels of spending in the future.

The Outlook for Stock Market Investors

So, what does all this mean for the stock market in the near future? The overall outlook for consumer spending is somewhat mixed. While the consumer has remained resilient, inflationary pressures, rising credit card debt, and the potential for a slowdown in the labor market all present risks to continued spending.

That being said, there are still opportunities for investors. Sectors like luxury goods, e-commerce, and travel are likely to continue benefiting from strong consumer demand. At the same time, companies in the financial sector, particularly credit card providers, could see a boost from rising borrowing costs, though they should remain cautious of any consumer credit crisis.

Ultimately, stock market investors should monitor consumer health indicators closely—consumer sentiment, debt levels, savings rates, and job market trends. These factors will provide valuable insight into the future direction of the economy and the companies that will thrive in it.

As always, diversification remains a key strategy for managing risk. While consumer-facing companies may face challenges, other sectors—such as technology and energy—may continue to perform well, regardless of consumer sentiment. In this volatile economic environment, a well-rounded portfolio could be the best approach for long-term investors.

This article provides a comprehensive look at how the health of U.S. consumers can affect the stock market. Would you like me to dive deeper into any of the points discussed or explore potential investment strategies based on these trends?