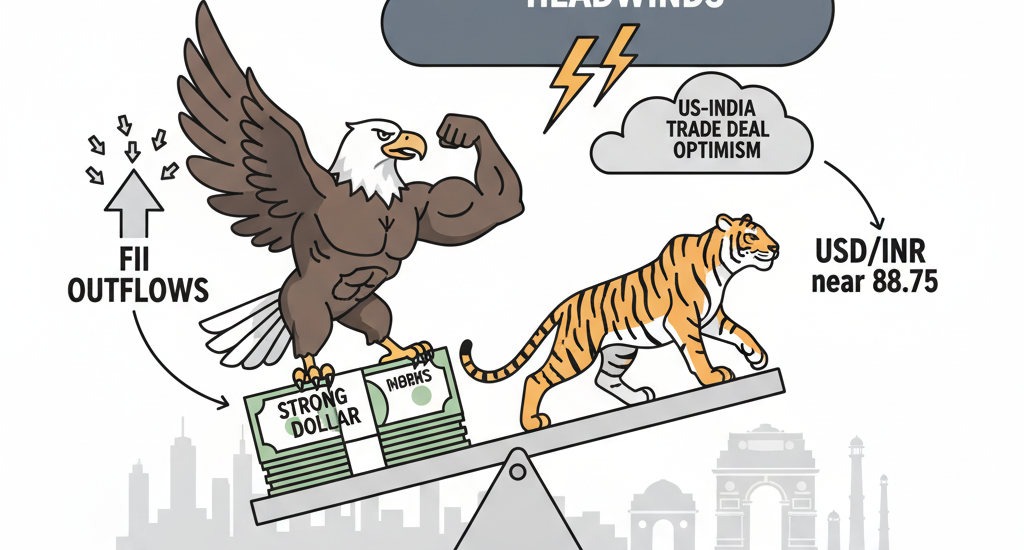

In a week marked by optimism over a potential US-India trade deal, the Indian rupee still found itself on the defensive. Despite positive diplomatic signals and improving global sentiment, the USD/INR pair edged higher toward 88.75, reflecting persistent structural challenges in India’s currency landscape. For investors and market watchers, this development offers a crucial reminder: short-term optimism can often be overshadowed by deeper macroeconomic currents.

Rupee Weakens Amid Trade Deal Hopes

The latest price action in the USD/INR pair underscores the complex interplay between political optimism and economic fundamentals. While both Washington and New Delhi expressed positive tones about strengthening trade relations, the rupee failed to gain traction.

US President Donald Trump’s recent comments about his “excellent relationship” with Prime Minister Narendra Modi, along with his hint of a potential India visit next year, briefly lifted sentiment in domestic markets. However, the move was not enough to offset the broader headwinds facing the rupee.

In normal circumstances, such diplomatic developments would be viewed as a catalyst for capital inflows and currency strength. But current market behavior tells a different story—investors are cautious, prioritizing global risk sentiment, yield differentials, and liquidity over trade rhetoric.

FII Outflows Weigh on Market Confidence

One of the primary reasons behind the rupee’s muted response is the continued selling by Foreign Institutional Investors (FIIs). The Indian equity market has seen net outflows for the third consecutive session, suggesting a growing preference for safer assets amid global uncertainty.

When FIIs pull money out of Indian equities or bonds, they convert their rupee holdings into dollars, thereby increasing demand for the greenback. This process naturally exerts upward pressure on the USD/INR pair, as seen this week.

Despite India’s robust long-term growth story, foreign investors have become increasingly sensitive to short-term global cues—rising US Treasury yields, a strong dollar index, and uncertainty over geopolitical tensions. The net result is a rupee that continues to trade on the weaker side of its recent range, even in the face of positive domestic developments.

Dollar Dominance Persists

Another key factor supporting the dollar and weighing on the rupee is the strength of the US Dollar Index (DXY), which remains elevated around 99.80. The DXY’s resilience is a reflection of ongoing risk aversion and the market’s expectation that the US Federal Reserve will keep interest rates higher for longer to ensure inflation stability.

A stronger dollar globally translates into weaker emerging-market currencies, including the rupee. Even as the Indian economy demonstrates solid GDP growth and relatively contained inflation, global investors continue to favor the safety and yield advantage of US assets.

This environment makes it difficult for the rupee to sustain gains unless there is a decisive turnaround in the DXY or a surge in foreign inflows.

Technical Picture: Bulls Retain Control

From a technical perspective, the USD/INR pair remains in a bullish zone. The currency pair is currently hovering near its 20-day Exponential Moving Average (EMA) at 88.60, signaling strong near-term support.

Moreover, the 14-day Relative Strength Index (RSI) has moved above the 60 mark—an indicator that momentum may be shifting back toward buyers. This suggests that unless there is a sudden surge in rupee demand, the pair could retest its previous record high near 89.12 in the coming sessions.

On the downside, support for the rupee lies around 87.07, which coincides with the August 21 low. A break below this level could indicate renewed strength in the Indian currency, but for now, the trend remains biased toward the dollar.

Macroeconomic Underpinnings: Trade, Inflation, and Oil

Beyond short-term technicals, the rupee’s performance also reflects India’s macroeconomic backdrop. The country’s trade deficit remains elevated, driven by strong imports and steady demand for crude oil. As one of the world’s largest oil importers, India is particularly vulnerable to fluctuations in global energy prices.

When oil prices rise, India’s import bill expands, increasing the demand for US dollars and exerting pressure on the rupee. Although oil has remained relatively stable in recent weeks, any renewed geopolitical tension—especially in the Middle East—could quickly tilt the balance.

At the same time, domestic inflation has stayed above the Reserve Bank of India’s (RBI) comfort zone for much of the year. While the central bank has kept policy rates steady, its cautious tone suggests that it will continue to monitor price pressures closely. A stable but cautious monetary policy means the RBI is unlikely to aggressively intervene to strengthen the rupee unless volatility becomes disruptive.

RBI’s Stance: Controlled Flexibility

The Reserve Bank of India has long maintained a policy of allowing the rupee to find its fair value while intervening only to prevent excessive volatility. This approach helps preserve foreign exchange reserves and maintain investor confidence in the market’s natural price mechanisms.

Recent price movements suggest that the RBI is comfortable with the rupee hovering in the 88–89 range, provided the depreciation is orderly. The central bank’s interventions, when they occur, are typically aimed at smoothing sharp moves rather than defending a specific level.

For traders, this implies that volatility in USD/INR will likely remain contained, but sustained rupee appreciation will require a shift in broader macroeconomic trends, such as a weaker dollar or renewed FII inflows.

US-India Trade Deal: A Long-Term Catalyst, Not a Quick Fix

The potential US-India trade deal has generated optimism about deeper economic cooperation and potential tariff reductions between the two nations. However, currency markets tend to discount such political developments until they translate into measurable trade and investment flows.

If the deal progresses and leads to increased US investment in India’s manufacturing, defense, and digital sectors, it could provide a long-term boost to the rupee by improving the current account balance and strengthening foreign exchange inflows.

For now, though, traders are focusing on the immediate fundamentals—FII flows, inflation trends, and global risk sentiment. These near-term factors are likely to dominate USD/INR movements until the trade deal moves from headlines to execution.

Global Context: Mixed Risk Sentiment

Global market sentiment remains uneven. While optimism around trade diplomacy provides some tailwinds, concerns over US-China tensions, Middle East conflicts, and slowing global growth continue to drive risk aversion. Emerging-market currencies, including the rupee, often bear the brunt of such volatility.

Adding to the mix, US bond yields remain near multi-month highs, drawing capital away from emerging markets. This trend underscores why, despite positive domestic headlines, the rupee’s upside remains capped.

Outlook: Rupee’s Path Ahead

For investors and traders, the outlook for the rupee over the next few months will depend on a few key factors:

- Dollar Index Trends: A sustained pullback in the DXY could offer some relief to the rupee, particularly if global investors rotate back into emerging-market assets.

- RBI Interventions: Subtle but steady RBI activity in the forex market could help cap volatility and prevent runaway depreciation.

- FII Behavior: Renewed foreign inflows into Indian equities and debt would provide fundamental support to the rupee.

- Global Oil Prices: Stable or lower crude prices would ease the pressure on India’s current account deficit and help stabilize the currency.

If these conditions align, the rupee could gradually strengthen toward 87 levels. However, if global uncertainty persists and dollar demand remains firm, the pair may hover near the upper end of its range, between 88.50 and 89.00.

Final Thoughts: Patience Over Panic

From an investor’s standpoint, the recent weakness in the rupee is not a cause for alarm but a reflection of current global realities. India’s economic fundamentals remain sound, with strong growth potential, a vibrant manufacturing base, and robust domestic demand.

In the short term, the USD/INR uptrend reflects global risk dynamics more than domestic weakness. Once inflation moderates and FII confidence returns, the rupee could find firmer footing.

As a stock market expert, I believe this period offers an opportunity for long-term investors to stay patient. The rupee’s short-term softness could set the stage for stronger capital inflows once macro conditions improve. The US-India trade optimism, while not an immediate catalyst, reinforces the long-term bullish case for India’s economic narrative.

Until then, the message is clear: the rupee may bend under global pressures, but it is far from breaking.