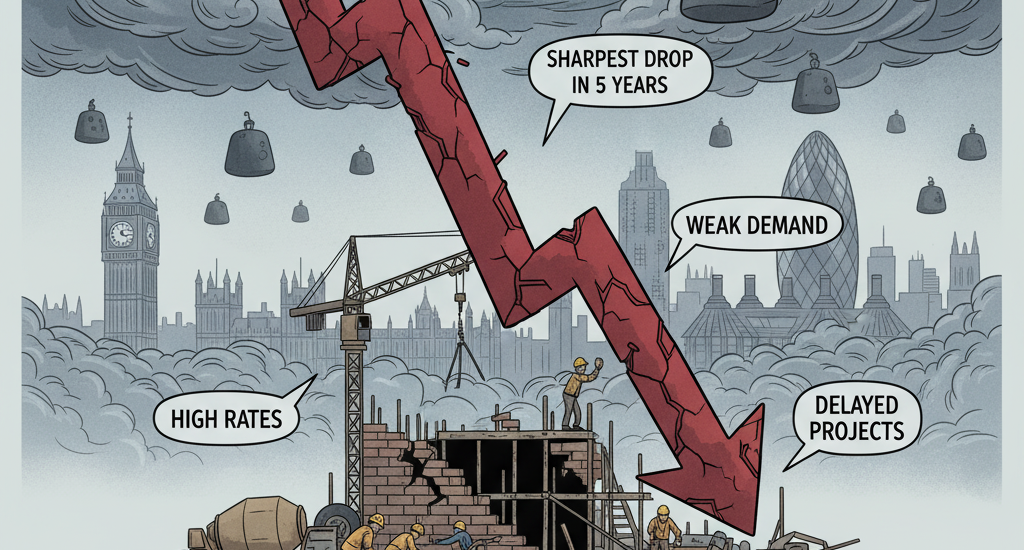

The latest data from S&P Global has sent ripples through the financial and real estate markets. The UK Construction Purchasing Managers’ Index (PMI) for October dropped to 44.1, down from 46.2 in September, marking the steepest decline in construction activity in more than five years. For market analysts and investors, this signals growing strain across one of the most economically sensitive sectors — a development that could ripple far beyond bricks and mortar.

The Numbers That Matter

A PMI reading below 50 typically indicates contraction. The latest figure of 44.1 is not just below that threshold; it is the lowest since the pandemic’s early disruption in May 2020. What’s even more concerning is that the contraction is broad-based — affecting civil engineering, residential construction, and commercial projects alike.

- Civil engineering saw the sharpest fall, with an index level near 35.4, showing a steep drop in infrastructure projects.

- Residential construction, the heartbeat of the housing market, slumped to 43.6, reflecting weak demand and high financing costs.

- Commercial construction held up slightly better but still contracted, reflecting the cautious stance of corporations amid ongoing economic uncertainty.

Such widespread weakness across subsectors is rarely seen outside of recessions. It suggests that construction — a key pillar of the UK economy — is struggling under the weight of elevated interest rates, falling new orders, and fiscal restraint.

What’s Driving the Downturn?

The headline decline in activity stems from a combination of cyclical and structural factors. Let’s unpack them one by one:

- High Borrowing Costs:

The Bank of England’s aggressive rate-hiking campaign to fight inflation has made financing new projects considerably more expensive. Mortgage rates remain elevated, curbing housing demand, while commercial developers are facing higher yields on borrowed capital, forcing many to delay or cancel planned investments. - Weak Client Demand and Risk Aversion:

Developers and public-sector clients alike are becoming increasingly cautious. With uncertainty surrounding economic growth and potential fiscal tightening after the next general election, there’s a growing “wait-and-see” attitude that slows project approvals. - Reduced Infrastructure Spending:

Civil engineering’s deep slump reflects government restraint. Major infrastructure projects have slowed, with several regional and transport initiatives delayed due to cost overruns and funding constraints. - Supply Chain Stabilization but Low Demand:

Interestingly, input costs and subcontractor availability have improved — suggesting supply-side pressures are easing. Yet, this improvement highlights a demand-side problem: materials are cheaper and easier to procure simply because fewer projects are being started. - Lingering Inflationary Pressures:

Although inflation has eased from double-digit levels, it continues to squeeze margins. Builders are caught between rising wages, lingering material costs, and clients unwilling to accept higher prices.

The result? A sector that is operationally stable but financially strained — one where businesses are surviving, not thriving.

The Ripple Effect on Housing and Real Estate Markets

The housing market is perhaps the most visible casualty of the construction slowdown. With residential construction activity weakening, the pipeline of new homes is tightening — even as affordability issues persist.

For potential homebuyers, this could create a paradoxical situation: fewer homes being built just as demand begins to recover once interest rates ease. That imbalance could fuel price stickiness, keeping homes expensive even in a sluggish market.

For real estate investors, this data also signals caution. Property developers may continue to struggle with cash flow and financing costs, while construction-linked stocks could face short-term headwinds. However, for long-term investors, the decline could open up attractive valuation opportunities once the rate environment stabilizes.

Investor Takeaways: Reading the Market Signals

From an equity investor’s lens, the construction PMI isn’t just an industry report — it’s a leading indicator of economic health, business confidence, and credit conditions. The drop to 44.1 is sending a message that the post-pandemic recovery momentum is losing steam.

Here’s how different asset classes might react:

- Construction and Building Material Stocks:

Companies like CRH, Travis Perkins, and other infrastructure-related firms could experience short-term pressure as order books shrink. Investors may see earnings downgrades in the next quarter if this trend continues. - Homebuilders:

Major listed homebuilders such as Persimmon, Taylor Wimpey, and Barratt Developments might see weaker sales and a slowdown in new project launches. However, with their strong balance sheets, these firms could benefit from pent-up demand once interest rates begin to fall in 2025. - REITs and Commercial Property Firms:

Commercial real estate developers are facing both falling demand and higher financing costs. Office and retail spaces are still struggling with post-pandemic structural shifts, and the latest PMI data will likely compound investor caution in this space. - Bonds and Fixed Income:

The contraction in construction could be interpreted by bond markets as a sign that the economy is cooling. If the weakness spreads, it might strengthen the case for the Bank of England to consider rate cuts sooner than expected, which could support bond prices. - The Pound Sterling:

A softer economic outlook often weighs on the currency. If subsequent data confirm a slowdown in broader economic activity, the GBP may face renewed downward pressure, particularly against the USD and EUR.

A Silver Lining: Easing Costs and Improving Efficiency

Despite the bleak headline numbers, there are small positives to acknowledge. Input cost inflation has eased to its lowest level in a year, and subcontractor availability has improved — a sign that supply chains are normalizing after years of disruption.

This means construction firms can plan projects more efficiently and manage their budgets with greater predictability. However, without stronger demand, this improved efficiency may not translate into better profits in the near term.

Market Outlook: What Lies Ahead

Looking forward, most construction firms expect activity to stabilize or modestly improve in 2025, assuming borrowing costs begin to fall and public investment resumes. But much will depend on the timing and pace of the Bank of England’s monetary policy shift.

If inflation continues to cool and rate cuts arrive by mid-2025, we could see a rebound in housing and infrastructure spending later in the year. The pipeline for energy transition projects and digital infrastructure remains promising, suggesting long-term potential despite current turbulence.

However, in the near term, investors should prepare for lower corporate earnings in the construction and materials sector, along with subdued job creation and weaker demand for related financial products such as construction loans.

Final Thoughts: A Cautionary Pause, Not a Collapse

The UK’s construction downturn is serious but not catastrophic. The fall in PMI to 44.1 should be read as a pause driven by financial tightening and uncertainty, rather than an outright collapse in demand. Once interest rates begin to ease and government projects gain clarity, the sector could experience a meaningful rebound.

For now, though, investors and policymakers must tread carefully. The construction industry is not just a barometer of economic health — it’s a foundation for future growth. Its current weakness reminds us that the post-pandemic economy still stands on fragile ground.

In a world of inflation-adjusted caution and interest-rate fatigue, the message from the UK construction data is clear: the recovery isn’t over — it’s just waiting for the right conditions to build again.

2 thoughts on “UK Construction Activity Falls at Fastest Pace in Over Five Years: A Warning Sign for the Broader Economy”

Comments are closed.